Confluent (CFLT) Stock Analysis - Powering the Real-Time Revolution as the Enterprise Central Nervous System

In-depth Confluent (CFLT) stock analysis exploring competitive moat, strategic positioning, and potential to capture outsized growth in the mission-critical real-time data streaming market

When you order coffee via Starbucks’ app, within milliseconds your loyalty points update, personalised recommendations refresh, inventory across thousands of stores synchronises, and fraud checks silently occur. Behind all of this real-time magic? Event streaming, quietly orchestrated by platforms like Confluent.

Building on the success of Apache Kafka - an open-source framework its founders helped create - Confluent offers a fully managed, enterprise-grade platform designed to transport, process and share data in real-time.

In this article (Part 1), we explore how Confluent established itself as the 'control plane' for data-in-motion, discuss why the market remains nascent, and identify Confluent’s key competitive advantages and challenges.

In Part 2, we bring this home with an analysis of financial performance and valuation, and the overall investment case.

Contents

1 - Why does confluent exist?

Event streaming 101

Confluent’s origins

Building the Central Nervous System

2 - Market landscape and growth drivers

What’s driving adoption?

Industry outlook

3 - All roads lead to Confluent

Current competitive position

Incumbents

Hyperscalers

Emerging alternatives

Data platforms

4 - Powering the system (7 powers analysis)

Counter positioning

Scale economies

Network effects

Switching costs

Branding

Process power

Cornered resource

Conclusion

1 - Why does Confluent exist?

Event streaming 101

Traditional data architectures run on batch processing: data is collected, cleaned, and processed hours - or even days - after it's generated. Event streaming flips that model. At its simplest, event streaming means each piece of data (e.g. a click, payment, or sensor reading) is treated as a live, immediate update rather than saved and processed later in batches. Each event travels instantly through systems, like electricity through a circuit, sparking actions immediately.

Imagine a customer clicking “purchase” - and within 300ms:

A fraud detection model is triggered,

The inventory system updates,

A personalised email is queued, and

A real-time dashboard reflects the transaction.

That’s event streaming.

Contrast this with traditional batch processing- where data from that same transaction might only update systems hours later, potentially causing missed fraud alerts, oversold inventory, or delayed customer insights.

Overall, the use cases are compelling:

Real-time user experiences drive higher engagement.

AI systems require live data to avoid model drift.

Operational resilience improves with instant visibility and replayable logs.

Cloud-native systems depend on scalable, distributed pipelines.

Confluent’s origins

In 2011, LinkedIn engineers Jay Kreps, Neha Narkhede, and Jun Rao encountered a universal problem: their legacy data pipelines simply couldn’t handle LinkedIn's exploding real-time data needs. Frustrated by clunky batch processes delaying critical user notifications and analytics, they built Kafka - initially a side-project - which rapidly transformed into critical data infrastructure for Netflix, Uber, and beyond.

However, its rapid adoption exposed problems: complex operational demands, steep learning curves, and patchy security standards. Seeing Kafka’s rapid adoption alongside these operational challenges, the trio envisioned something bigger: a fully-managed, secure, enterprise-grade platform. This vision became Confluent’s mission to build a 'central nervous system' for data, unifying disparate apps and systems in real-time.

From day one, the team understood Kafka’s open-source DNA was integral to its success. Confluent has maintained its deep commitment to the open-source community, remaining one of Kafka’s top contributors, regularly publishing research, and actively engaging developers through meetups and its flagship annual conference, Current. This careful balance - leveraging open-source innovation while delivering proprietary enhancements - has been central to the company’s sustained leadership.

Building the Central Nervous System

As Kafka became the de facto standard for streaming data, the ubiquity created what CEO Jay Kreps calls a “foundational missing layer” in modern IT architecture - a central pipeline for data connecting all software systems so they can react intelligently to events as they happen. Confluent positions itself as the enterprise partner best-equipped to handle these sophisticated data-in-motion demands.

“businesses need data infrastructure that provides connectivity across the entire organisation with real-time flow…and the ability to build applications that react…in real-time. We think this new stack will evolve to be the central nervous system of every company” - Jay Kreps

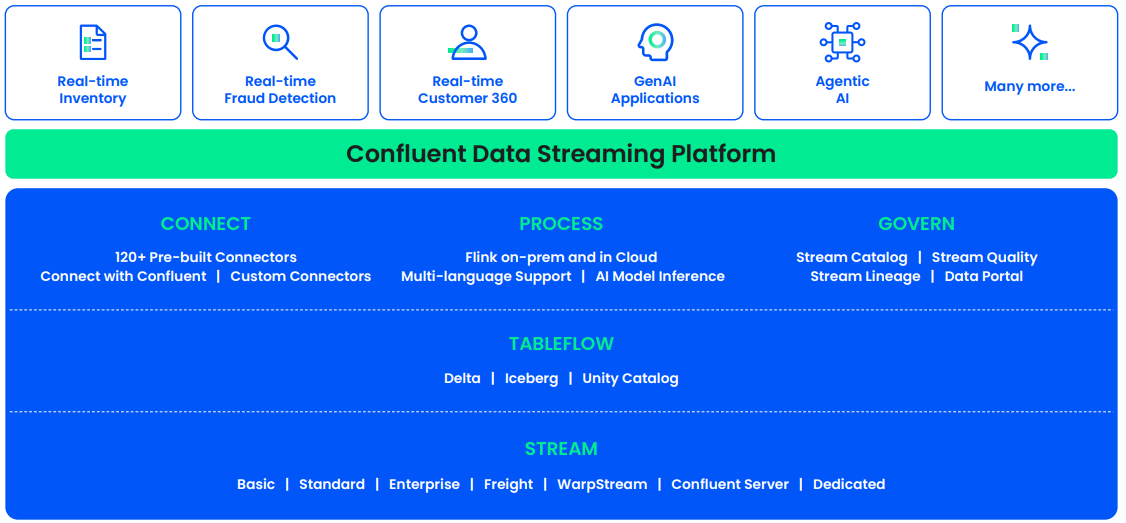

While Kafka remains key for transporting events, enterprises also need a way to transform, govern and share those events. Where Confluent began as “Kafka-as-a-service”, the company has evolved a much broader vision: a universal control plane for real-time event streams. Confluent’s platform is designed to:

Ingest and connect data in real time from over 120 connectors,

Process events with Flink (via its Immerok acquisition),

Govern data through schema registries, lineage, and RBAC,

Share it securely with external teams or partners via Stream Sharing, and

Seamlessly integrate analytics with Tableflow .

Together, these innovations form a virtuous cycle: processing enriches Kafka streams; governance builds trust; sharing and Tableflow enable immediate consumption by analytics and AI.

Wrapped within Confluent Cloud and powered by the proprietary Kora engine, the platform offers unmatched serverless elasticity, multi-cloud compatibility, and reliability - qualities few in-house teams or even hyperscalers can replicate fully.

2 - Market landscape & growth drivers

What’s driving adoption?

The world is demanding immediacy, and over the past 10 years the amount of data processed in real time has exploded - the global digital data generated rose from roughly 2 zettabytes in 2010 to about 181 zettabytes by 2025, a c.90x increase.

This growth has been driven by companies like Shopify, whose Black Friday sales now spike at nearly $4m per minute. Managing inventory in real-time across thousands of merchants worldwide, avoiding overselling and instantly detecting fraud - this demand isn't optional; it's mission-critical. Similarly, in autonomous vehicles, real-time data streams are not just critical but life-saving - sensor data processed milliseconds late can lead to catastrophic outcomes.

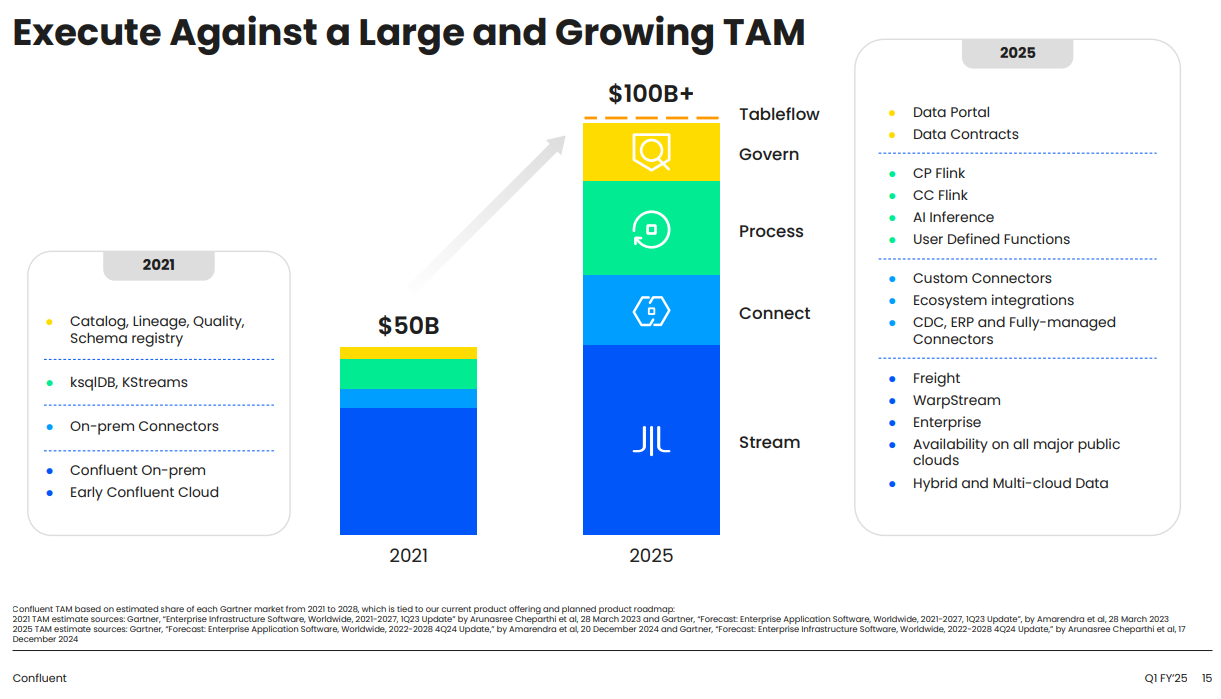

Batch-based systems aren’t capable of serving this demand, with this real-time precision requiring exactly the type of event-driven infrastructure Confluent provides. As a result, the company’s total addressable market (TAM) has grown c.20% per year since 2021 to more than $100b today.

Industry outlook

Looking forward, event streaming represents a fundamental shift in how enterprises manage and leverage data, with the potential to reshape enterprise IT by enabling instantaneous interactions with real-time information across all facets of a business.

While the pace at which enterprises shift away from legacy systems remains uncertain, the direction is inevitable. Numerous drivers are accelerating this transition in an increasingly digital landscape:

Proliferation of IoT: With c.17 billion IoT devices in use today, companies are shifting compute closer to the data source to reduce latency and network load - making stream processing a critical enabler.

Edge computing & decentralised architectures: Gartner estimates that in 2025, 75% of enterprise-generated data will be created or processed outside traditional data centres. This decentralisation reinforces event-driven architectures to handle data close to where it’s generated.

AI, ML & real-time insights: Integrating real-time data into AI-driven systems (e.g., recommendation engines, fraud detection, autonomous systems) requires low-latency event streams. The rapid expansion of the big data market (from $240b in 2021 to projected $655b by 2029 - a c.15% CAGR) underscores this need.

Regulatory pressure & privacy-by-design: Regulations like GDPR, CCPA, and evolving ePrivacy frameworks are pushing businesses to adopt real-time event processing for compliance - tracking consent events, data access, and erasure requests with immediacy.

Composable/modular platform architectures: Emerging cloud-native trends emphasise loosely coupled, API-driven systems (microservices, serverless compute, event mesh) vastly simplifying scale and maintainability. The movement toward Kappa architecture, domain-driven event channels, and event-sourced systems demonstrates demand for stream-native design.

3 - All roads lead to Confluent

Current competitive position

In an increasingly crowded landscape of data integration solutions - including traditional message queues, enterprise ETL tools, cloud-native messaging platforms, and emerging open-source technologies - standing out requires significant mindshare and momentum.

Apache Kafka has emerged as the dominant standard in event streaming, with widespread adoption by more than 150,000 companies, including approximately 75% of the Fortune 500. This broad penetration has fostered a powerful developer ecosystem, often referred to as a self-reinforcing "developer flywheel," creating deep expertise, abundant resources, and extensive compatibility across platforms.

Confluent strategically capitalises on Kafka’s established position. By enhancing Kafka’s core capabilities and building complementary proprietary solutions, Confluent leverages Kafka's ubiquity and ecosystem momentum to establish meaningful competitive differentiation. However, sustaining this advantage requires continually navigating competitive pressures from multiple directions:

Incumbents (IBM, Tibco, Oracle)

One of Confluent’s fiercest opponents is not a flashy new platform but plain old inertia. For years, enterprises have shuttled data from transactional databases to warehouses with Informatica workflows or bespoke scripts, accepting multi-hour latency as “good enough.” Confluent must prove that seeing analytics seconds after an event - not the next morning - creates business value worth the added architecture.

While secular forces are working in its favor, the “if it ain’t broke” instinct remains a hurdle, and entrenched middleware continues to power mission-critical queues in banking and other regulated industries. Confluent addresses this challenge by positioning Kafka as a scalable, cost-effective, and open ecosystem alternative, promoting its benefits such as reduced costs per throughput and cloud-native agility.

Overall, this is a slow burn. Confluent’s strategy is to gradually replace these systems by initially complementing them in high-volume / real-time contexts, gaining enterprise mindshare, and being on the front foot when a breakup happens.

Hyperscalers (Microsoft, Google, AWS)

Major cloud vendors (Microsoft with Azure Event Hubs, Google with Pub/Sub and AWS with MSK and Kinesis) offer native streaming solutions that directly compete with Confluent. These hyperscalers attract enterprises through convenience, bundled pricing, and integration with cloud-native services.

Yet Confluent continues to stand apart. Because it’s cloud-agnostic, customers can run the same managed service across AWS, Azure, GCP, and on-prem infrastructure, stitching together pipelines that ingest data in one environment, process it in another, and land results wherever they choose. Feature depth is another differentiator: proprietary capabilities (self-balancing clusters, enterprise-grade security, the high-performance Kora engine, and more than 120 pre-built connectors) go well beyond the “primitive” functionality developers typically associate with single-cloud Kafka services.

In practice, many customers start with MSK or Event Hubs, but when workloads demand multi-region scalability, rigorous governance, or deep Kafka expertise, they graduate to Confluent. For example, a global retailer began with AWS MSK but faced challenges when scaling beyond North America. After encountering complexities around multi-cloud synchronisation, governance, and disaster recovery capabilities, it migrated seamlessly to Confluent - leveraging its robust, cross-cloud managed service and enterprise-grade governance capabilities.

Emerging alternatives (Apache Pulsar, Redpanda)

Newer technologies like Redpanda and Apache Pulsar have gained attention by addressing perceived limitations of Kafka.

Redpanda re-implements Kafka’s API in C++ and eliminates ZooKeeper, presenting itself as a drop-in replacement for teams that need ultra-low latency or want to sidestep Kafka’s operational complexity. Redpanda usage remains modest today but could become increasingly relevant if its promise of simpler management and performance advantages gain wider adoption.

Apache Pulsar, open-sourced by Yahoo in 2016, offers a different take on distributed streaming with segmented storage, native multi-tenancy, and unified support for both queue and pub/sub semantics that enable fine-grained isolation and complex routing. StreamNative, founded by Pulsar’s original creators, positions itself as a “Confluent for Pulsar,” and several vendors now expose a Kafka-compatible layer to ease migration. Analysts increasingly describe Pulsar as the most serious rival to Kafka - even if, in practice, only a small slice of Confluent customers have switched or run side-by-side evaluations.

Confluent’s playbook is to neutralise any advantage quickly. Features Pulsar trumpeted early are now standard in Confluent, and performance claims by Redpanda have been met by the Kora engine.

For now, Redpanda and Pulsar have had limited commercial impact. Their existence, however, keeps the bar high: Confluent must continue to innovate on performance, openness, and developer experience or risk giving users a reason to explore these leaner alternatives.

Data platforms (Snowflake, Databricks)

A subtler subplot in Confluent’s competitive narrative involves Snowflake and Databricks. Today these vendors complement, rather than confront, Confluent: they specialise in analytics and AI while depending on Kafka-level plumbing for the event stream itself. The strategic risk emerges only if either player decides to build a native, fully-featured streaming broker and pushes it across an already-entrenched customer base.

Snowflake’s heritage is “data at rest,” yet it keeps inching toward real time. Features like Snowpipe Streaming and dynamic tables shrink ingest latency, but the architecture still favours micro-batch loads over the torrent of high-frequency messages Kafka excels at. Most deployments therefore pair Confluent for ingestion with Snowflake for warehousing—an arrangement Snowflake itself highlights in reference designs.

Databricks travels a parallel path. Spark Structured Streaming and Delta Live Tables handle continuous processing, yet they still lean on an external bus (typically Kafka or Pulsar). In 2025 the two companies deepened their partnership, wiring Confluent Tableflow directly into the Databricks Lakehouse so that real-time events feed analytics and AI models without friction - hardly the stance of imminent rivals.

Confluent’s defensive play is straightforward: embed itself so deeply inside these ecosystems that displacement feels more painful than partnership. The expanded Databricks integration - promising “production-grade, real-time AI” - illustrates the tactic. By positioning Kafka as the streaming backbone for Snowflake’s warehouse and Databricks’ Lakehouse, Confluent reframes would-be competitors as allies and turns co-existence into lock-in of its own.

4 - Powering the system

Competitive moat analysis – 7 Powers Framework

Overall, Confluent has been able to successfully expand market share and out compete these rivals. The key question is if its early success can be sustained, and if it will be able to leverage its current foothold to gain an outsized share of the rapidly developing market.

To clearly evaluate Confluent's competitive positioning, we apply Hamilton Helmer's "7 Powers" framework. This structured lens enables an assessment of Confluent's strengths, areas of vulnerability, and long-term strategic resilience.

Counter positioning

Rating - Weak (Stable)

Initially, Confluent’s rise benefited from counter-positioning against legacy middleware providers, whose rigid and costly licensing structures made responding to open-source, subscription-based streaming solutions difficult. However, today, cloud providers and open-source competitors lack the structural constraints legacy incumbents faced. Although Confluent’s multi-cloud, vendor-neutral approach provides some differentiation, it’s not significantly restrictive to competitors. Consequently, counter-positioning currently offers minimal competitive insulation.

Overall, we now consider this power weak because it doesn’t significantly prevent competitors from attacking Confluent’s turf. It remains stable - Confluent will continue to differentiate as neutral/open, but this alone isn’t a hard-to-cross moat with the current competitive dynamics.

Scale economies

Rating - Weak (Stable)

When a firm truly wields Scale Power, each incremental unit becomes cheaper to produce in a way rivals cannot replicate, creating a runaway cost advantage. While Confluent has scaled significantly - operating tens of thousands of Kafka clusters and investing heavily in R&D - its scale economies appear weaker when compared to cloud providers like AWS, Microsoft, and Google.

Though Confluent enjoys significant operational efficiencies against smaller, niche competitors, this advantage diminishes substantially when placed alongside the vast resources of the cloud giants, limiting the long-term defensive value of scale economies.

Network effects

Rating - Weak (Stable to Slightly Increasing)

True network effects (where each additional user directly enhances the platform’s value) remain modest at Confluent. However, indirect ecosystem effects, notably Kafka’s expansive developer community and a growing integration ecosystem, do add substantial value.

Confluent’s nascent "Stream Sharing" feature, if widely adopted, could potentially strengthen these indirect network effects significantly. Nevertheless, current network effects, while present, are relatively limited in their competitive defensibility.

Overall, we consider network effects weak in Confluent’s moat. They exist in a limited form, but are not as self-reinforcing as, say, a user network. We expect this to remain mostly stable; Confluent will cultivate its ecosystem and possibly create stronger network effects (e.g. if data sharing or a marketplace takes off), but for now this isn’t the primary source of advantage.

Switching costs

Rating - Strong (Increasing)

Imagine a global bank running tens of millions of daily transactions through Confluent’s real-time fraud detection system. Switching to another platform isn't merely costly - it risks downtime, regulatory compliance issues, and billions in transactional uncertainty. These formidable barriers exemplify Confluent’s deep switching-cost moat.

With Confluent’s solutions so deeply embedded into mission-critical processes with extensive integrations, the potential operational disruption and high migration costs significantly deter enterprises from switching to alternatives. As Confluent expands its integrated solutions and deepens customer reliance, these switching costs continue to increase, solidifying customer retention.

Overall, switching costs remain one of Confluent’s strongest moats and we see them continuing to increase over time as Confluent broadens its platform.

Branding

Rating - Weak (Stable)

Confluent enjoys strong recognition among data architects and enterprises familiar with Kafka, yet its brand remains closely associated with Kafka itself, rather than uniquely distinguished.

While the Confluent brand does reduce sales friction and instills trust among large enterprise clients, it rarely commands pricing power independently, frequently leading to competitive pricing pressures from hyperscalers. Unless Confluent can significantly elevate standalone brand prestige, branding power remains stable but weak.

Cornered resource

Rating - Moderate (Stable to Slightly Weakening)

Confluent’s extensive expertise and leadership in Kafka - stemming from its founders, key engineers, and proprietary technologies such as the Kora engine- represent meaningful competitive resources.

These assets are somewhat defensible but not wholly exclusive, as competitors increasingly attract Kafka specialists and develop rival technologies. While Confluent continues to benefit from significant operational experience and proprietary insights, these resources remain vulnerable over time as industry knowledge disseminates broadly.

Process power

Rating - Moderate (Stable to Slightly Weakening)

Operational excellence and the sophisticated management of Kafka-based streaming services represent genuine process advantages for Confluent. These strengths manifest in consistently high reliability, low latency performance, and a disciplined innovation pipeline, evident in streamlined releases and sophisticated platform features.

Nonetheless, as many of these processes become more openly documented and understood across the industry, this advantage may weaken over time. For instance, AWS’s adoption of containerised deployments and automated cluster management illustrates how quickly hyperscalers can replicate best-in-class operational practices.

Overall, while process power remains a key part of Confluent’s competitive advantage, we expect this to be slowly eroded over time.

Conclusion

Overall, we rate Confluent’s competitive position as robust and likely to endure, though not invulnerable. The company enjoys meaningful switching costs, emerging network effects, and high-quality people and processes - but it faces several strategic threats that could disrupt its trajectory.

As discussed earlier, hyperscalers, emerging alternatives, and competing data platforms each pose significant challenges and could gradually chip away at Confluent’s market position. Winning this market requires relentless innovation - a strength Confluent has demonstrated consistently. However, any slowdown could quickly see Confluent’s real-time advantage freeze over, leaving it vulnerable to disruption.

Ultimately, the data-driven future belongs to those who can instantly capture, analyse, and act upon events. Confluent, at the epicenter of this shift, stands uniquely positioned - provided it continues innovating at pace, embracing open-source collaboration, and delivering a superior managed-service experience. In doing so, it won’t merely participate in the data revolution - it will power it - becoming the central nervous system of the data revolution.

That concludes Part 1. If you’ve made it this far, it would be great to hear your thoughts on the business and any pushbacks or challenges you have vs. our viewpoints.

In Part 2, we round out the discussion by diving into what this means for financial performance and our overall investment thesis.

Subscribe to get similar reports on today’s greatest companies straight in your inbox. If you enjoyed my writing, a like is always much appreciated.

Disclaimer

This article is provided for information purposes only. This article has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but the authors do not warrant its completeness or accuracy. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This article is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The authors do not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein.

Sources

markets.ft.com

geekwire.com

businessinsider.com

confluent.io