Catching a falling Snowflake - $SNOW Investment Thesis and Valuation Analysis

Now is an attractive time to start building a position in a high-quality name exposed to strong secular growth trends and with several meaningful growth catalysts that will drive long-term returns.

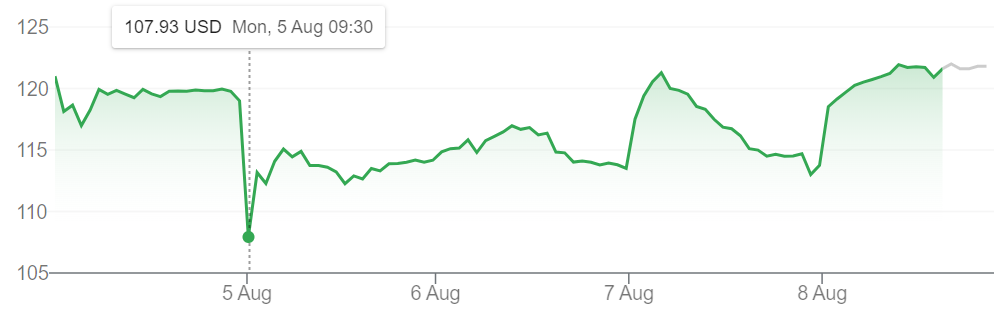

Snowflake, the once market-darling, briefly hit an all-time low of $108/sh - (55%) below its IPO price and (72%) below its peak of $392.

While the company has since traded back up to ~$122, we believe that at this level, Snowflake’s valuation is still supported by conservative forecasts, including moderating growth in both customers and NRR.

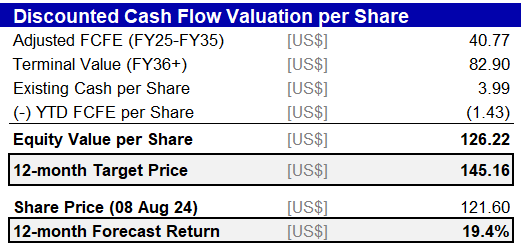

Based on a DCF methodology, we value Snowflake at $126.22/sh - c.4% above its latest trading price. We believe now is an attractive time to start building a position in a high-quality name that is exposed to strong secular growth trends and with several meaningful growth catalysts that will drive long-term returns.

Some of the key assumptions included in our valuation are:

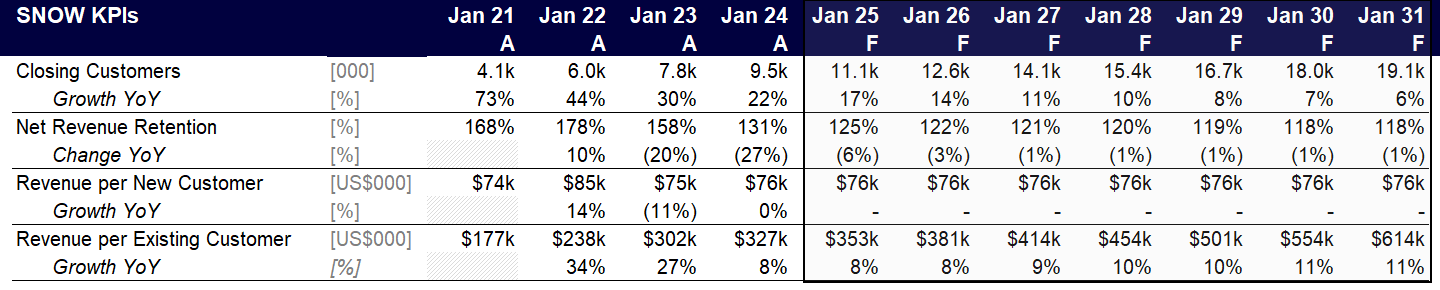

Further declines in customer growth, with 17% for FY25 (vs. 22% in FY24 and 20% in Q1 FY25) and an ongoing decline of c.5% p.a.

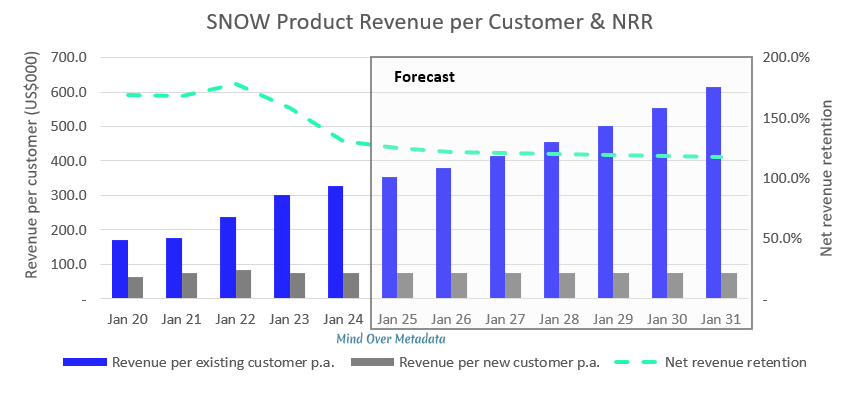

A continued reduction in NRR as the company’s customer base matures, with a forecast NRR of 125% for FY25 (vs. 131% for FY24).

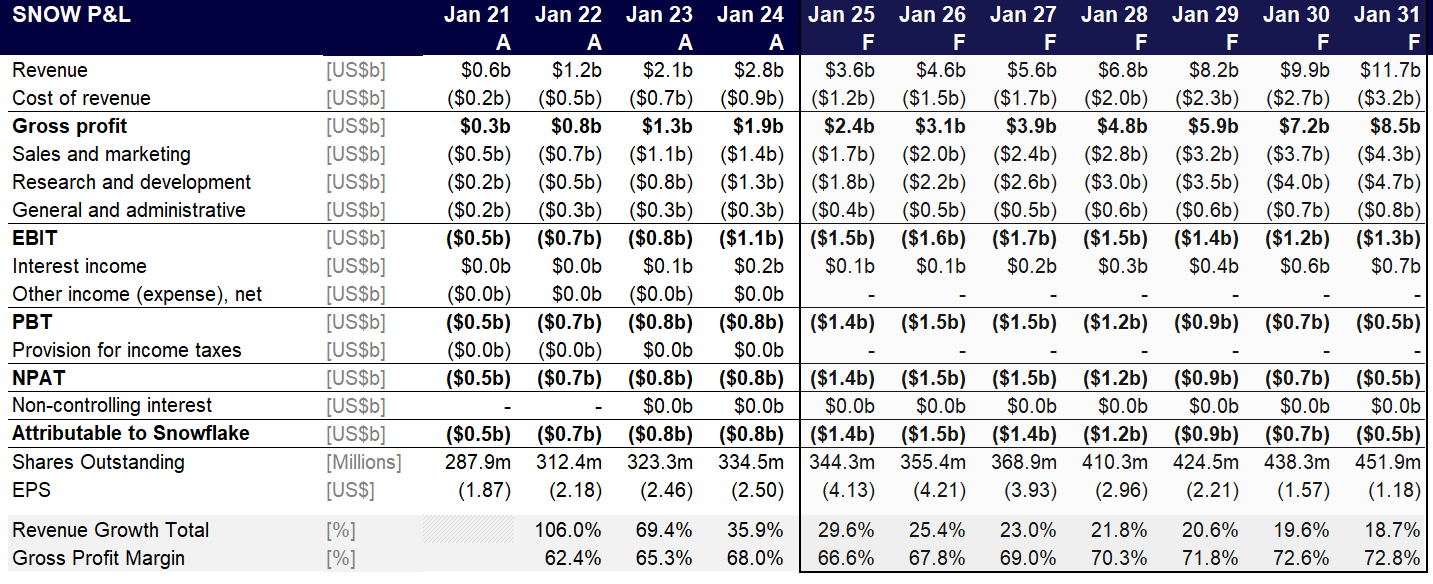

A decline in gross profit margin to 66% in the near term, with an average increase of 1% p.a. over the mid-term.

A 15% cost of equity and terminal growth of 4.7% p.a. post FY35.

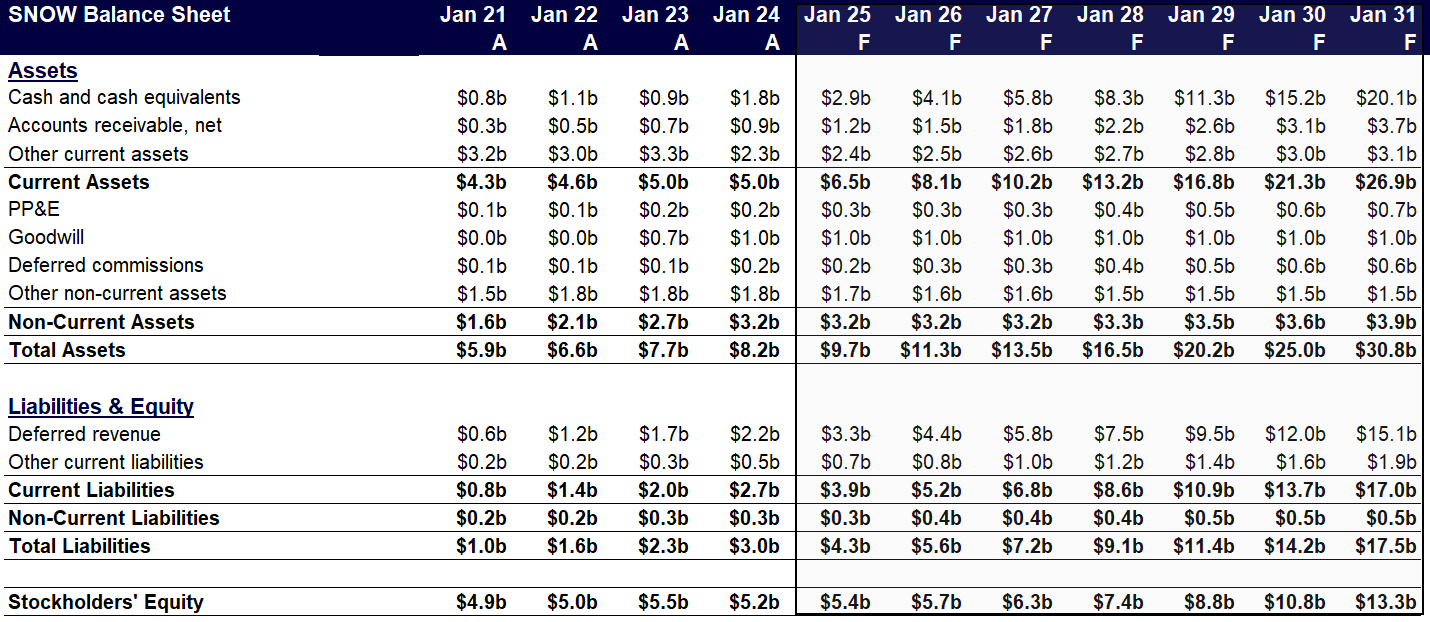

Providing further upside to our DCF, we assume that the material amount of cash being generated remains on the balance sheet and is underutilised (c.$21b by FY31). Finding accretive ways to deploy this capital, whether through customer acquisition or M&A, would add $28 (+23%) to our valuation if the company was able to earn a 10% p.a. return on this capital, while a 20% p.a. return would add $116 (+92%).

In the rest of this article, we dive deeper into the investment thesis, the background of the business, and key value levers. This is broken down into the following sections:

Investment thesis

How does Snowflake make money?

Revenue Model

Historical Performance & Outlook

What are Snowflake’s key costs?

Cost of Revenue

Operating Expenses

The Impact of Stock-based Compensation

Appendix: Financial Forecasts

Disclaimer:

This analysis is provided for informational purposes only and should not be considered as investment advice. While I strive to provide accurate and up-to-date information, all investment decisions should be based on your own research and consultation with a qualified financial advisor. I do not accept any liability for any losses or damages incurred based on the information provided. Always consider your financial situation, risk tolerance, and investment goals before making any investment decisions.

1. Investment thesis

Product development is expected to fuel growth through a tough macro environment.

We believe prolonged negative sentiment has been driven by moderating revenue growth amidst a movement to a more constrained macro environment. Simultaneously, Snowflake has lacked products geared toward unstructured data and, as a result, has been unable to capitalise on increasing corporate investment in generative AI workloads.

While near-term macro headwinds may persist, new CEO Sridhar Ramaswamy (appointed Feb 2024) has created a positive momentum that we expect will enable Snowflake to generate strong growth despite the constrained spending environment.

Ramaswamy was previously Senior Vice President of Ads and Commerce at Google, where he oversaw all of Google's advertising and commerce products, including AdWords, AdSense, and Google Shopping.

Ramaswamy has focused on accelerating product development and innovation across Snowflake’s platform, especially in AI and machine learning capabilities.

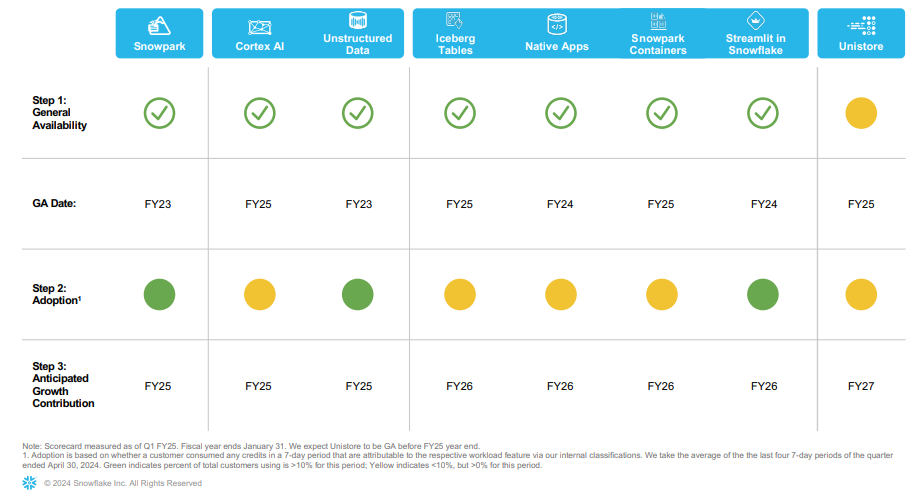

Some of the key products expected over the next 2 years are:

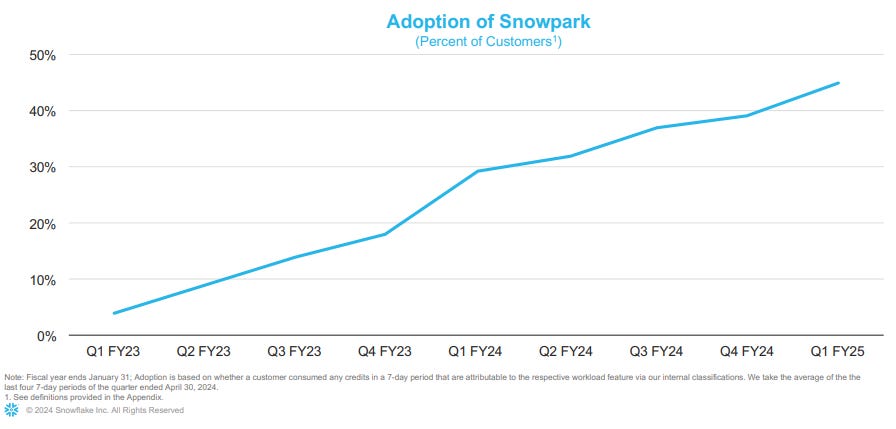

Snowpark enables customers to write code in languages like Python, Java, and Scala to manipulate and analyse their data directly on Snowflake's platform.

Now close to c.50% adoption, growth is expected to continue steadily as additional services are introduced and existing customers are further educated on use cases.

Container Services is a part of the Snowpark framework, designed to enable developers to run containerised workloads within the Snowflake data cloud.

Container Services will expand the kind of applications that can run on top of Snowflake and is expected to be generally available in the second half of 2024.

Dozens of partners are already building solutions that will leverage container services to serve their end customers.

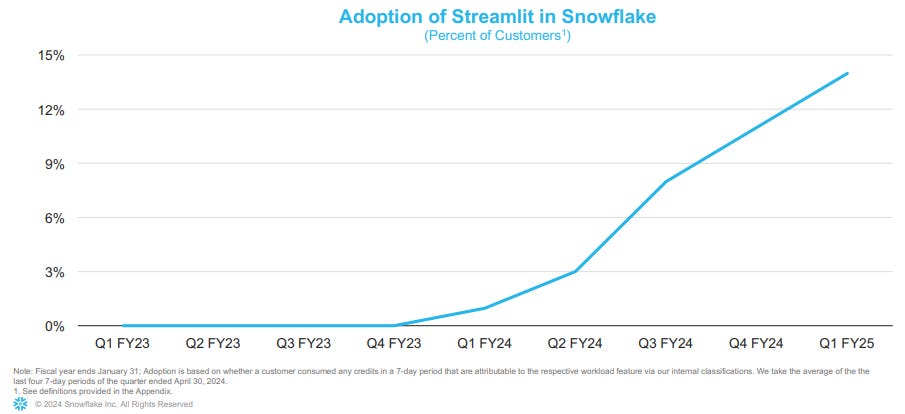

Streamlit, an open-source Python framework for data scientists and AI/ML engineers to deliver interactive web apps, is integrated with Snowpark.

Streamlit is not yet generally available on all three clouds, expected at the end of 2024.

Cortex, now generally available, facilitates the deployment, management, and monitoring of ML models. As customers ramp up usage, this is expected to contribute materially to FY25 revenue growth.

Iceberg is an open table format for managing large datasets, with features like versioned data, time travel, and incremental processing. Iceberg capability is expected to be generally available in the second half of 2024.

More than 300 customers are using Iceberg in public preview and many of Snowflake’s larger customers have indicated that, as a result of Iceberg, they are likely to use Snowflake for more workloads.

The movement of data out of Snowflake and into Iceberg storage is expected to be a negative headwind in the near term. Offsetting this, Iceberg will significantly increase the amount of data available to run queries on. While this is expected to be a net positive over time, management anticipates it will be a net negative for FY25.

Unistore (Hybrid Tables) allows for real-time updates and low-latency queries, making them suitable for more transactional applications. Unistore is expected to be generally available in the second half of 2024.

Unistore opens up several new classes of applications that can run on top of Snowflake. These applications include workloads that require quick access to fresh data, such as real-time dashboards, operational analytics, and data-driven applications.

Snowflake is well-positioned as an industry leader that will benefit from long-term secular trends.

We believe that all companies will eventually adopt a cloud-centric operating model and that Snowflake is positioned to capture a significant share of this market (worth an estimated c.$70-100b p.a.) with its integrated, end-to-end solution.

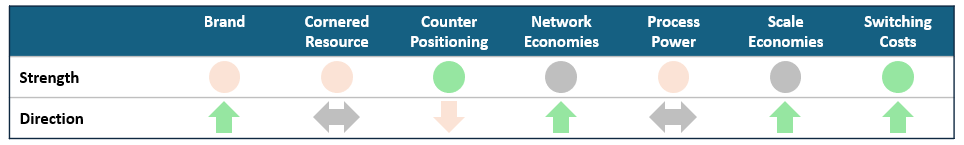

Using Hamilton Helmer’s 7 powers framework, we assess that Snowflake currently benefits from a combination of counter positioning and switching costs and is expected to strengthen its network and scale economies over time.

Brand: As a relatively new company vs. legacy data storage and analytics offerings, Snowflake does not have the same brand recognition. While we expect this to develop over time, we do not believe this will be a core driver of strategic differentiation.

Cornered Resource: Snowflake does not have cornered resources relative to key competitors.

Counter Positioning: Snowflake allows its customers the flexibility to avoid vendor lock-in and leverage a multi-cloud strategy, and the company’s cloud-native architecture is a significant advantage over traditional on-premises data warehousing solutions. Major cloud providers have been unwilling or unable to replicate this, particularly the separation of compute and storage.

Network Economies: Snowflake’s platform enables companies to share, connect, collaborate, monetise, and acquire live data sets. Nearly one-third of Snowflake customers share data products as of Q1 2025, +24% YoY, and we believe that growing its data marketplace is key to Snowflake’s value proposition and a potential source of long-term differentiation.

In addition, Snowflake integrates with a wide range of third-party tools and services, and increased use of the platform enables continued support of existing integrations and the introduction of new ones.

Process Power: Snowflake has limited process power relative to key competitors.

Scale Economies: Snowflake exhibits scale economies relative to potential new entrants; however, it has no comparative advantage over its direct competitors.

Switching Costs: Snowflake has substantial switching costs, comprised of:

The complexity, cost and time of migrating data to another platform.

The cost and difficulty of replicating data transformations, pipelines, and integrations that are specific to Snowflake's architecture.

The cost of rewriting applications to conform to the SQL dialect of another platform.

The operational disruption of switching platforms is in terms of the immediate time required to transfer and the time taken to retrain staff on a new platform.

Contractual obligations and prepayments that lock customers in for the near to medium term.

2. How does Snowflake make money?

Revenue Model

Snowflake provides a cloud computing platform that enables users to run various workloads on top of any of the 3 major Cloud Service Providers, or CSPs, being Google, Azure, and AWS.

This allows customers to consolidate data into a single source of truth to drive meaningful insights, apply AI to solve business problems, build data applications, and share data and data products.

The company’s cloud-native architecture consists of three independently scalable but logically integrated layers across storage, compute, and cloud services.

Centralised Storage

Snowflake ingests structured, semi-structured, and unstructured data to create a unified data record that is stored in a central repository in each account.

Indicative pricing structure:

Customers pay for storage either on demand at a $/TB/month rate or on a capacity basis, where a set dollar amount of usage is purchased upfront.

Prices typically range between c.$20-30/TB/mo on-demand (dependent on location and cloud service), with up to a 40% discount given for the largest capacity purchases.

Customers are charged per TB for data transfers between different regions or different cloud providers, prices ranging significantly between c.$20 and c.$190/TB dependent on the region/provider. Data transfers within region are typically free.

Multi-cluster Compute

Snowflake provides dedicated resources to enable users to simultaneously access common data sets for many use cases with minimal latency.

Customers can create and manage virtual warehouses, or Snowpark container services compute nodes, as needed to combine and process data from storage (respectively known as “Virtual Warehouse Services” and “SPCS Compute”).

Indicative pricing structure:

Rates are charged based on the effective size of the Virtual Warehouse or Compute Node while in operation.

Credits are consumed per second, with a 1-minute minimum every time the service is started or resumed.

Credits start at $2/credit for the Standard plan, with $3/credit for Enterprise and $4/credit for Business Critical.

Cloud Services

Snowflake’s Cloud Services segment includes the suite of functionalities that run on Snowflake’s cloud infrastructure, including:

Snowpark and integrations with machine learning libraries and tools. This feature facilitates machine learning model development and execution directly within Snowflake.

Secure data sharing and integration with third-party AI and ML platforms.

Advanced SQL functions and tools for analytics that support machine learning workflows.

Automatic scaling, concurrency management, and data storage optimisations.

Automatic Query Optimisation and other performance enhancements.

Features for monitoring and anomaly detection.

Indicative pricing structure:

Cloud Services are charged based on the amount of compute resources used while operating the service, at 4.4 Credits per hour of use.

AI Features are charged per million tokens used and differ based on the LLM. For example, using Cortex Fine-Tuning (Training) for llama3-70b costs 3.4 Credits per million tokens.

Historical Performance & Outlook

Customers

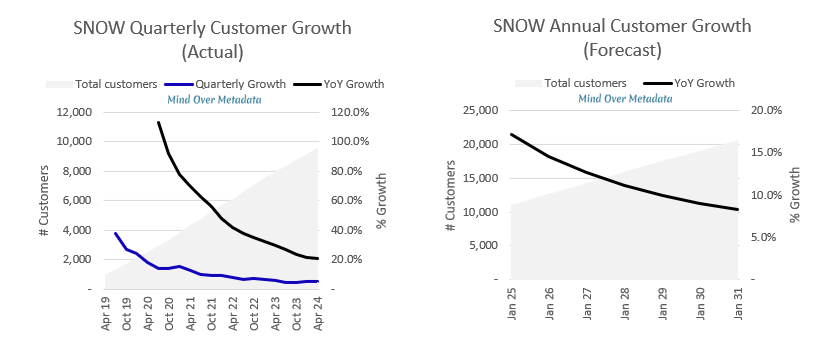

Snowflake’s customer growth has declined over time as the company has added a relatively consistent number of customers to a growing base.

The company added 1.7k customers in FY21, 1.8k in FY22, 1.8k in FY23, and 1.6k in FY24, and we forecast this to remain relatively stable with a slight decline over time. This equates to an 11% CAGR from FY24-31.

Product Revenue per Customer

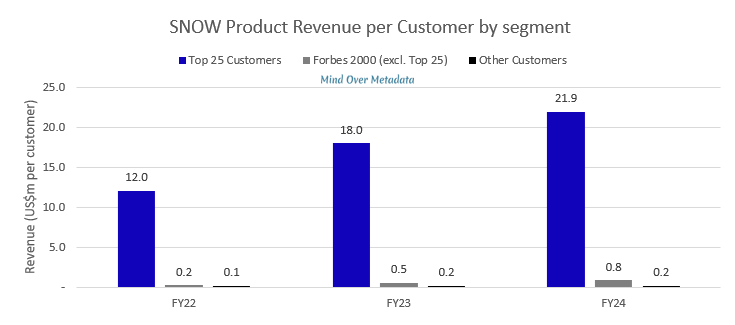

Snowflake’s strategy is to “Land and Expand”, investing in acquiring customers that will compound over time.

Revenue is not seen immediately at <$100k per customer in the year of acquisition; however, grows substantially as they increase their usage and adopt a greater range of products and services.

Revenue per new customer added each year has fluctuated over time, climbing from $63k in 2020 to a peak of $85k in 2022 before returning to $75k in 2023-2024. We forecast this figure to be flat over time.

Revenue per existing customer nearly doubled between 2020 and 2024 from $171k to $327k/customer.

Over the past two years, Snowflake had strong per-customer growth across all segments, with 35% p.a. growth in its top 25 customers, 108% p.a. growth for other Forbes 2000 customers, and 14% p.a. growth for the remaining customer base.

We forecast a 9% CAGR in revenue per customer from FY24-31, compared to an 18% CAGR from FY20-24. We believe this is conservative, with significant upside potential from an increased product development cadence driving more use cases within businesses.

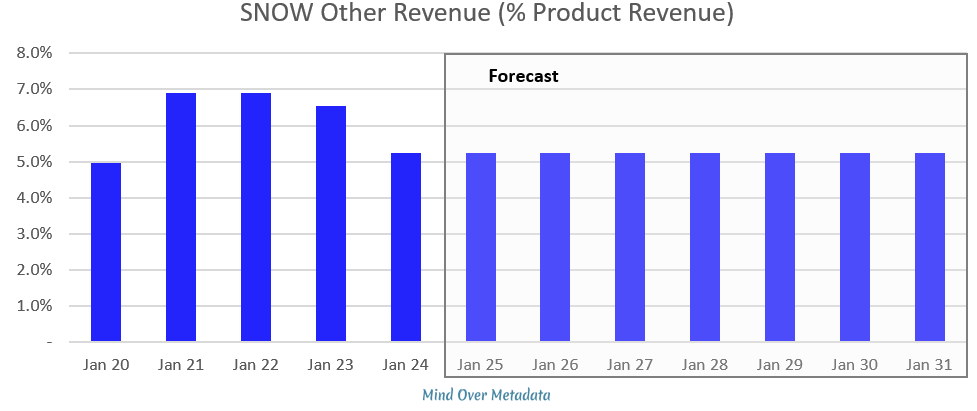

Other Revenue

Snowflake generates other ad hoc revenue from professional services, including customer implementations and migrations from legacy solutions. We assume this revenue remains constant as a proportion of product revenue.

That covers revenue, now on to costs.

3. What are Snowflake’s key costs?

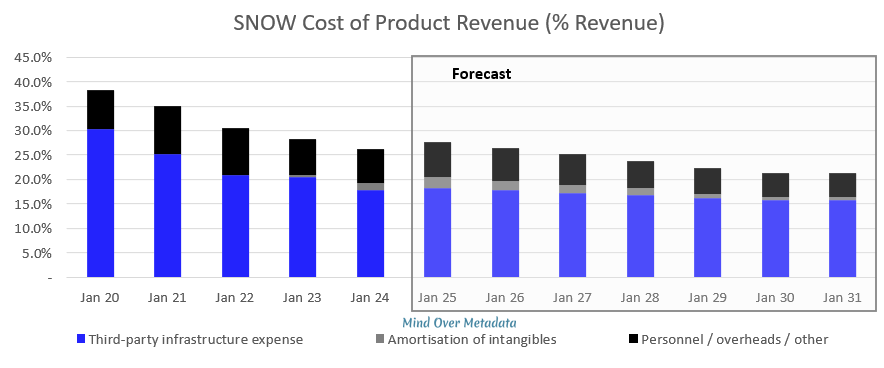

Cost of Product Revenue

Snowflake’s most substantial product revenue cost is third-party infrastructure, at c.18% of revenue in FY24, followed by personnel/other overheads at c.7% and amortisation of software development costs at c.2%.

The company has achieved significant margin improvement over time as its scale has allowed for greater purchasing power and bulk discounting; however, infrastructure expenses have recently come under pressure.

Key costs include:

Third-party infrastructure expenses incurred in connection with the customer's use of the Snowflake platform and its deployment and maintenance on public clouds, including different regional deployments.

Personnel and overheads include expenses associated with customer support, maintaining service availability, and platform security.

Amortisation expenses relate to capitalised internal-use software development costs and acquired intangible assets.

Snowflake has now had two consecutive quarters, Q4FY24 and Q1FY25, in which costs increased as a percentage of revenue. Management attributes margin pressure to newly launched product capabilities and features that have not yet reached economies of scale and GPU-related costs as the company invests in new AI initiatives.

We forecast higher costs holding at current levels for FY25. However, we expect the trend of margin improvement to continue in the longer term as compute becomes increasingly commoditised and capacity catches up with demand.

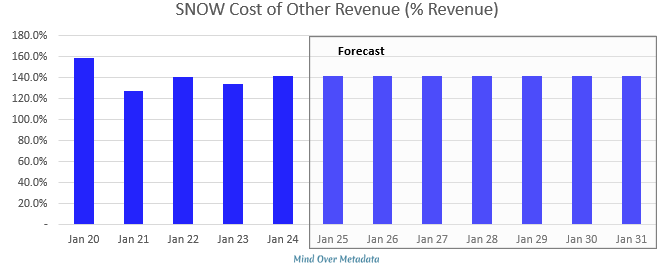

Cost of Other Revenue

Snowflake's costs to provide other revenues include charges from global system integrators, managed service providers, and resellers.

This activity has historically been undertaken at a loss, which I hold constant moving forward.

Operating Expenses

While not separately reported as a category, Snowflake has commented that personnel costs, consisting of salaries, benefits, bonuses, stock-based compensation, and sales commissions, are the most significant component of operating expenses.

In addition to staff, there are a range of other expenses split up into the three categories below. These include referral fees paid to third parties, advertising costs, third-party R&D, subscriptions, and corporate expenses.

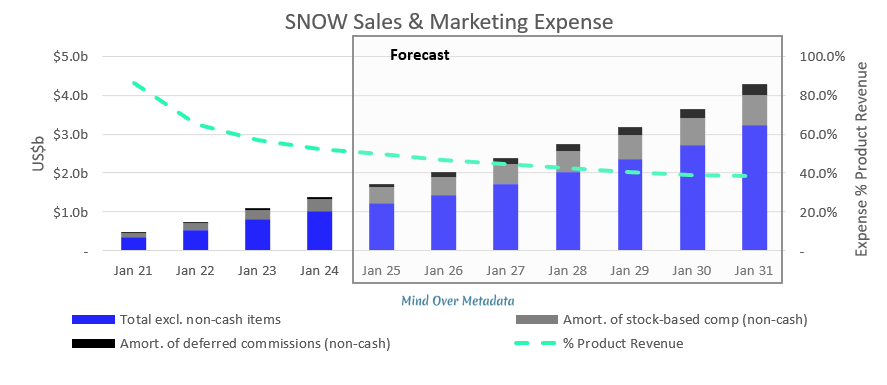

Sales & Marketing

Sales & Marketing is expected to remain Snowflake’s largest expense as the company continues to spend money on winning and retaining customers; however, we expect it will fall as a % of revenue over time as incumbents make up an increasing proportion of the customer base and retention is typically cheaper than acquisition.

We forecast a c.18% p.a. increase in the total expense from FY24-31, falling from c.52% of revenue to c.40% of revenue.

Key costs include:

Sales and marketing staff, sales commissions, certain referral fees paid to third parties, advertising costs, business development, and travel.

Note that sales commissions tied to customers’ consumption are expensed in the same period as they are earned, while commissions and referral fees earned upon contract origination are deferred and then amortised over five years.

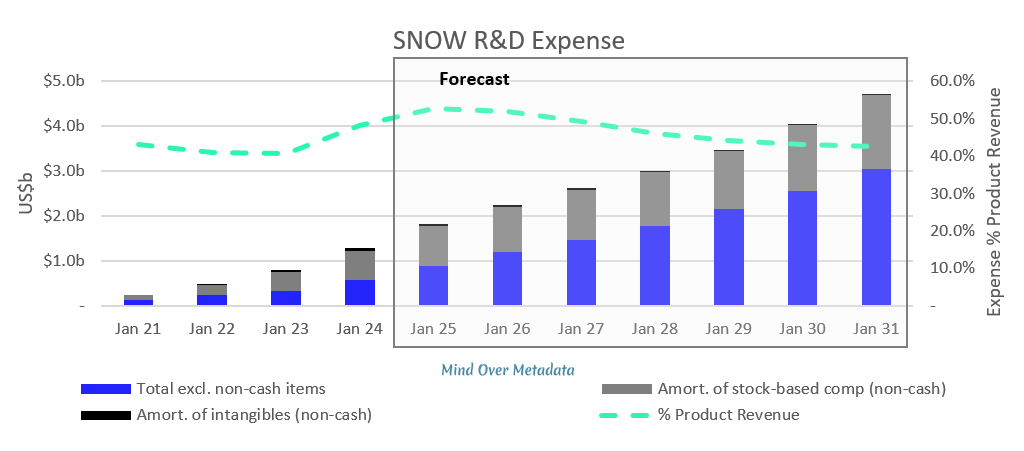

Research & Development

Due to a significant increase in product development efforts, we expect R&D costs to continue climbing in the next few years before stabilising.

We forecast a c.20% p.a. increase in the total expense from FY24-31, falling from c.48% of revenue to c.43% of revenue.

Key costs include:

R&D staff, contractor and professional services fees, third-party platform development costs, amortisation of acquired intangible assets, and software and subscription services.

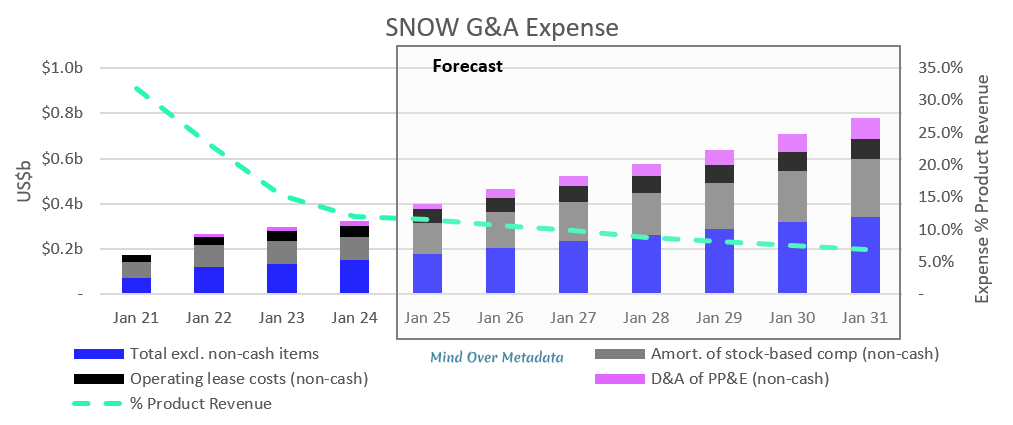

General & Administrative

After significant increases in 2021-22 of >50% p.a., growth has since fallen closer to 10% p.a. We have assumed a near-term increase to 18% for FY25, declining toward a long-term rate of 10% over time.

Key costs include:

Finance, legal, human resources, facilities, and administrative staff, professional services fees, software and subscription services, and other corporate expenses.

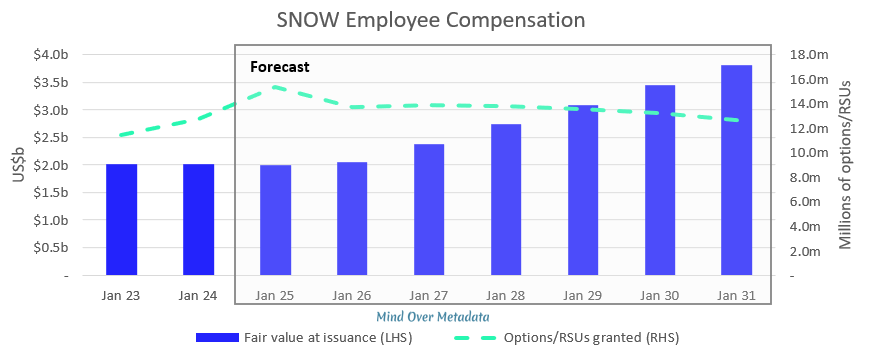

The Impact of Stock-based Compensation

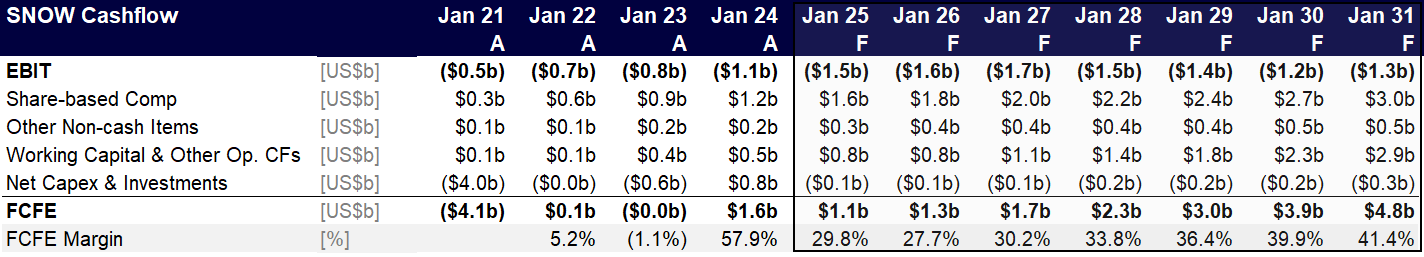

Stock-based compensation (SBC) makes up more than a third of total operating expenses. Given its significant size and dilutive impact on shareholders, this causes concern for many investors.

Our stance is that using SBC rather than cash is positive from both a valuation perspective and the ability to provide powerful incentives that align employees' interests with long-term shareholder value.

Breaking down Snowflake’s SBC expense:

Snowflake’s SBC is classified into two main types, equity-classified RSUs and stock options, with other issuance of restricted common stock or acquisition consideration undertaken ad-hoc.

Stock options: Earlier in Snowflake’s life, stock options were the primary compensation mechanism used by the company. The company ended 2020 with 81 million unvested options, with a weighted averaged exercise price of c.$7.5/sh. Since then the company has only issued another 1.5 million.

Equity-classified RSUs: This is now the primary method of compensation. In contrast to options, there is no payment required when these vest.

How does SBC impact valuation?

When a company uses SBC, it pays for a large proportion of its staff costs using equity at the current period’s share price, defers that payment by 1-4 years, and locks in staff / incentivises them to hit their KPIs.

Based on our forecasts for the next five years, this means the company can use an additional $11bn of cash, which it can spend on increasing its competitive position or on customer acquisition.

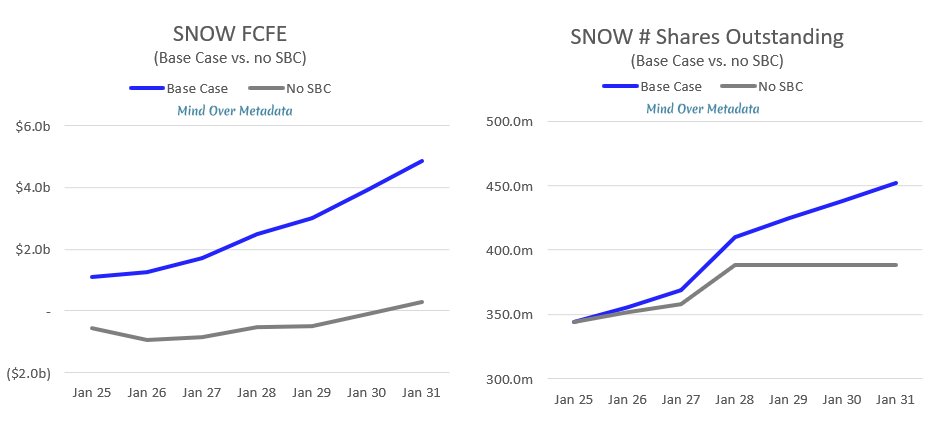

Excluding SBC, I estimate the fair value of Snowflake would more than halve. This is because the value of the cash ($11bn by FY31) significantly outweighs the dilutive impact (c.17% increase in shares outstanding by FY31) on a DCF basis.

What I haven’t factored in here is that Snowflake would also need to raise c.$2b in equity to remain solvent under a no-SBC scenario.

That’s it for today. If you found this research interesting, tap the ♥ button and make sure to share it with friends and colleagues who love technology and investing as much as you do.

If you want to read more about the companies at the forefront of innovation that are best positioned to capture value and become generational businesses, then make sure to subscribe and receive our latest updates.

Appendix: Financial Forecasts

Disclaimer:

The content shared on this Substack is for informational and educational purposes only and does not constitute financial advice.

I am not a licensed financial adviser, and nothing in this publication should be interpreted as personalised financial advice, a recommendation, or an offer to buy or sell any financial product.

Investing involves risk. You should seek advice from a licensed financial adviser in your country before making any investment decisions. Past performance is not indicative of future results. Any opinions expressed are my own and do not reflect the views of any affiliated organisations.

By reading this publication, you agree not to hold the author liable for any decisions you make based on the information provided.