The Trade Desk: The Winning Bid?

Who is The Trade Desk, why is the market valuing the company at five-year lows, and why we see TTD as a long-term compounder worth owning

After a c.70% drawdown, The Trade Desk ($TTD) now sits in a far different place than the one investors priced for just one year ago. The multiple has compressed, growth expectations have reset, and sentiment has swung from “category winner” to something closer to “prove it.” The key question: is this a painful but temporary reset, or a sign that TTD’s long-standing advantages are eroding as premium CTV supply consolidates and walled gardens tighten their grip? Our view leans toward the former.

While the path ahead is bumpier than the last decade, the company’s role in the open internet—neutral, data-rich, and increasingly infrastructural—still supports a constructive long-term outlook. This article unpacks the competitive dynamics behind today’s pessimism and why the current price may offer an attractive entry point for long-horizon investors.

Who is The Trade Desk?

Founded in 2009, The Trade Desk (TTD) grew out of Jeff Green’s belief that digital advertising should function more like a modern, rules-based market—transparent, automated, and driven by data rather than relationships. Green often framed the mission simply: build the “Goldman Sachs of advertising,” a platform where pricing is clear, decisions are made in real time, and buyers have granular control over how and where budgets are deployed.

Green spent his early career pushing against structural inefficiencies in the digital ad market. After selling AdECN—among the first electronic ad exchanges—to Microsoft in 2007, he saw up close how closed systems and opaque pricing limited advertiser control and muddied price discovery. That experience shaped his conviction that digital advertising would eventually resemble modern financial exchanges.

TTD was his attempt to build that marketplace—an independent demand‑side platform (DSP) where advertisers and agencies can plan, manage, optimise, and measure campaigns programmatically across channels such as CTV, mobile, audio, and display.

From day one, Green positioned TTD not as an agency competitor but as the infrastructure that supports them. That neutrality has long been both a strength and a limitation: TTD earns trust because it doesn’t own media or consumer relationships, but it also gives up the control that integrated platforms enjoy.

That trade-off worked when data and inventory were abundant, but the question now is whether neutrality has run its course—and whether investors should underwrite structurally lower share gains and a slower mix shift toward the highest-yielding inventory.

The market for advertising

The Ad Tech ecosystem

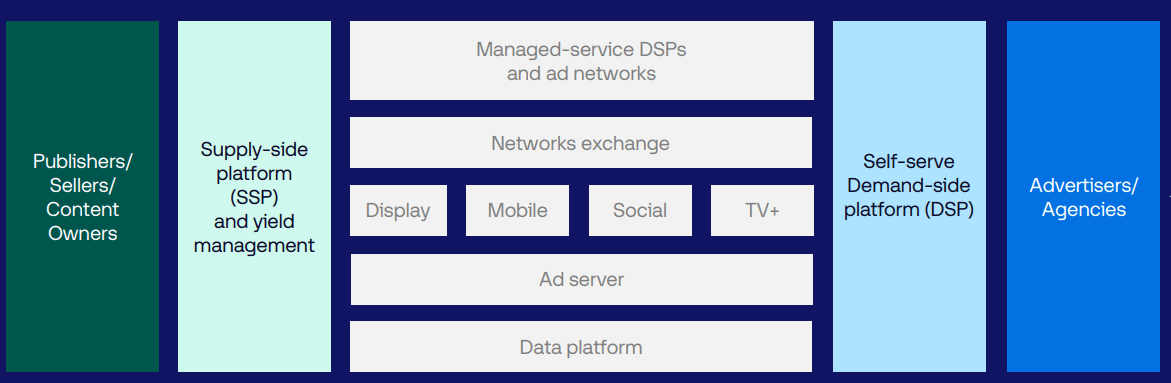

The ad-tech ecosystem is crowded and often confusing, with many intermediaries sitting between advertisers and publishers. TTD’s role is to simplify this path by giving buyers a single place to access inventory across channels and exchanges. The below visuals from the company’s Q2 2025 investor presentation highlight this structure, but the key point is straightforward: TTD acts as the connective layer that helps buyers navigate a fragmented landscape.

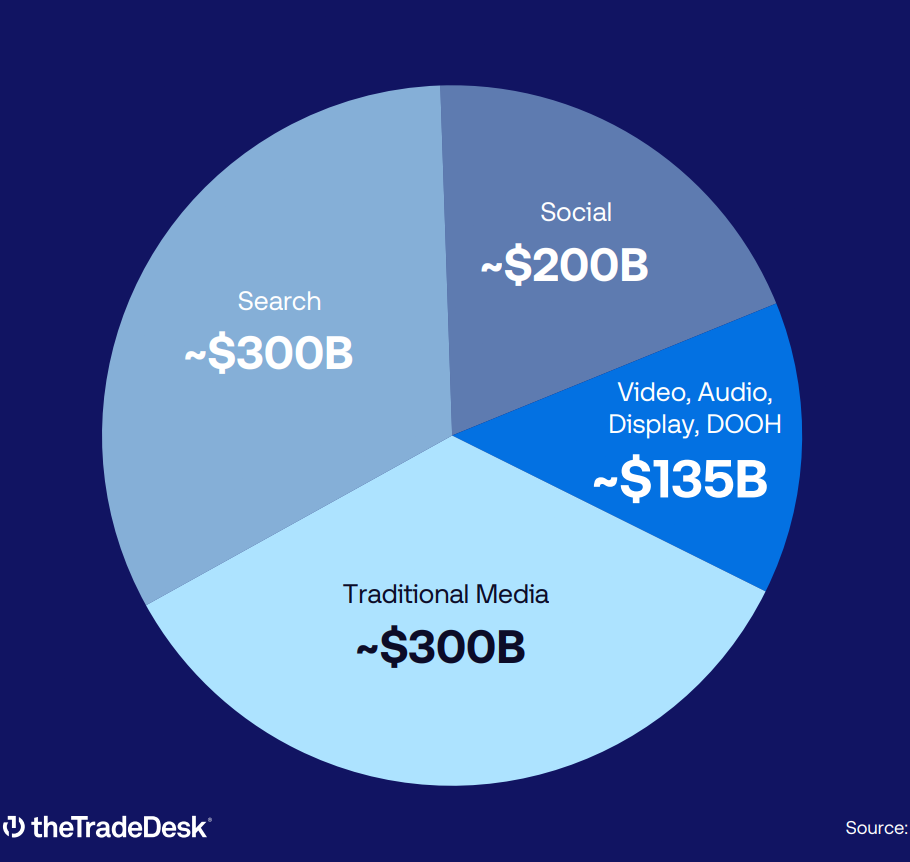

This matters because advertising is one of the largest markets globally, with nearly $1 trillion in annual spend. TTD sits inside the $135b open-internet portion of that market—a slice defined by its accessibility to independent platforms and its mix of video, retail media, and other digital formats. With TTD’s take rate sitting around c.20%, this translates to TAM of c.$26b.

With TTD’s revenue at $2.4b today, that equates to about 9% penetration of its current addressable market—forecast to grow 5–7% annually. While that offers a healthy runway, sustaining 15–20% growth implicitly requires continued market share gains over time.

Ecosystem overview

Source: The Trade Desk investor presentation Q2 2025

Video

Video—especially Connected TV (CTV)—is the largest and fastest‑growing part of the open internet. Analysts estimate CTV makes up roughly 50% of TTD’s $2.4b revenue base, and it remains the company’s main growth engine as budgets move from linear TV into streaming.

Linear still commands c.$140b in global ad spend, more than 3x the size of today’s CTV market, which shows how much runway remains. For TTD specifically, the ceiling is set less by total CTV growth and more by how much of that linear-to-streaming migration remains accessible via independent pipes rather than locked into vertically integrated sales channels.

Retail

Retail media is becoming a more important focus for TTD. Retailers use their first‑party shopping data to target ads with high intent, and this data can be activated in two main ways:

Onsite: Ads shown on a retailer’s own websites (e.g. sponsored listings on Walmart.com).

Offsite: Ads that use retailer data to reach consumers across the open internet (e.g. Walmart ads on YouTube) and direct them back to the retailer’s platform.

Other channels

Beyond video and retail, TTD supports other formats that round out its role as a unified programmatic platform:

Audio: Ads on streaming music, podcasts, and internet radio.

Digital Out‑of‑Home (DOOH): Ads on physical screens like billboards and transit hubs.

Display & Native: Traditional digital units—from banner ads to in‑feed formats—that offer broad reach and brand‑safe placements.

Growth areas

TTD’s near-term focus remains CTV and retail media, especially in North America, where the company generates c.90% of its revenue. Those are also the highest-yielding parts of the mix, which means success here has an outsized impact on both growth and gross margin durability.

Beyond this, several other vectors can drive expansion:

Expanding client base: TTD is using AI to widen its TAM. Its Koa AI copilot automates campaign setup and optimisation, helping smaller advertisers buy programmatically without agency support.

Geography: North America accounts for c.90% of TTD’s revenue but only c.40% of global ad spend, leaving meaningful international headroom as programmatic adoption accelerates abroad.

Channel expansion: More nascent formats—such as audio and DOOH—have room to grow, especially as cross-channel data improves targeting and measurement.

Magna 2024 Global Ad Spend Forecast

Source: The Trade Desk investor presentation Q2 2025

Competitive landscape

The industry is dominated by a few scale players

Programmatic advertising naturally rewards scale. Large advertisers often consolidate spend with a small number of DSPs to get cleaner cross-channel measurement, tighter frequency control, and better activation of their first- and third-party data. These feedback loops reinforce themselves—more demand leads to better optimisation, which attracts more demand. As a result, independent DSPs tend to drift toward winner-take-most dynamics, with the top one or two platforms capturing the bulk of scaled, multi-market agency relationships and the associated data exhaust.

This dynamic benefits TTD. It is the largest independent DSP in a field dominated by a few vertically integrated (“walled garden”) rivals, most notably Google’s DV360 and Amazon Advertising. While those platforms are anchored in their own ecosystems, TTD’s neutrality positions it as the scaled alternative across the open internet.

TTD positioned as the open market’s neutral alternative

TTD’s model is built around neutrality. Unlike walled gardens, it doesn’t own media or prioritise any publisher. Instead, it gives advertisers access to a wide mix of inventory through more than 100 integrated ad exchanges and SSPs. This independence lets TTD aggregate demand from agencies and brands and connect them to publishers across the open web. Walled gardens, by contrast, control both the inventory and the underlying user data.

Although walled gardens still capture the bulk of digital ad spend—roughly 50–70%—attention is fragmenting across streaming, audio, and retail media. As budgets follow that fragmentation, the case for an independent DSP that can unify reach, measurement, and identity across channels becomes stronger.

Recent issues and reasons for decline

In its Q4 FY24 earnings release (12 Feb 2025), TTD announced a major re‑organisation of its go‑to‑market teams—an implicit acknowledgement of rising competitive pressure in CTV and retail media.

Management also guided to slower growth, forecasting $575m of revenue for 1Q FY25, or +17% YoY — well below the 25–30% pace investors had grown accustomed to.

TTD share price

Source: Koyfin (10 Nov 2025)

Management pointed to temporary advertiser caution and uneven CTV ramp timing as the main drivers of slower growth. Investors read it differently, viewing the guidance as a sign of competitive pressure and possible share loss in premium CTV inventory. The market effectively reset the medium-term growth expectation from “compound in the high-20s” to “mid-teens with more uncertainty around CTV share.”

The stock fell c.30% after the release and continued to drift lower, with the multiple compressing from a “category winner” premium toward the low end of high-growth software peers.

A strong 1Q FY25 beat briefly lifted sentiment, but the rebound faded as management reiterated softer guidance in 2Q and 3Q. Shares now trade roughly 70% below the 52‑week high at c.7x LTM revenue — lower than nearly any other company with a similar growth trajectory and margin profile.

Has TTD lost its competitive edge?

Amazon’s competitive re-positioning

Amazon has been a competitor for years, but over the past 12–18 months its DSP has shifted from adjacent to directly competitive with TTD. Historically, Amazon’s ad business centred on retail media—monetising on‑site search and display inside its marketplace. Today, it has broadened into a full‑funnel ecosystem spanning retail, streaming, and third‑party inventory.

Amazon now blends its first‑party retail and streaming data with proprietary inventory and lower platform fees to create a closed, high‑performing DSP that appeals to performance‑oriented advertisers. This strategy accelerated in 2024–2025 as Amazon secured new CTV distribution and ad‑sales partnerships with Disney, Roku, and Netflix. Alongside its expanding Fire TV footprint and retail‑media network, these agreements give Amazon preferential access to high‑value CTV impressions that were once available through open‑internet exchanges.

For TTD, Amazon’s CTV push hits a core growth driver. As Amazon secures more premium CTV supply, the share available to independent DSPs shrinks—a dynamic that could constrain TTD’s long‑term growth if it continues.

The strategic risk extends beyond inventory access. For commerce‑heavy marketers, Amazon’s DSP can become the default performance rail: retail data, streaming inventory, and closed‑loop attribution all live in one place. Agencies will continue to multi‑home, but high‑intent, data‑rich campaigns may drift toward Amazon, leaving TTD with a mix that is more upper‑funnel and less defensible.

Threats from other ‘walled garden’ DSPs

Beyond Amazon, TTD also competes with integrated giants like Google DV360 and Meta Ads Manager. These platforms optimise for yield and data retention within their own ecosystems, trading neutrality for control. While they overlap with TTD across display, video, and CTV, their competitive positioning differs from Amazon’s in two important ways.

First, Google and Meta are inventory‑anchored. Their DSPs exist primarily to monetise owned media—YouTube and Search for Google; Instagram and Facebook for Meta—rather than to win share across the open internet. They have massive reach and unique data, but little incentive to push spend outside their walls.

Second, advertisers treat them as complements, not substitutes. Brands buy walled‑garden impressions through Google and Meta directly, then use TTD to manage everything else. Amazon, by contrast, is building a closed‑loop DSP explicitly designed to become the primary performance rail across both open and closed inventory. That makes Amazon’s threat more direct and strategically significant.

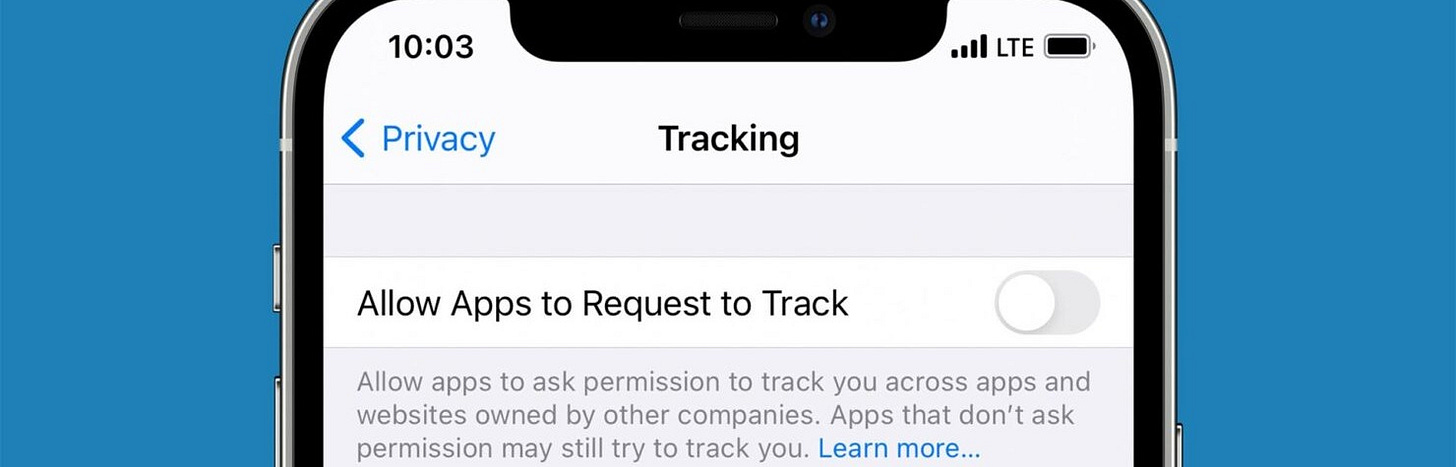

The shifting privacy landscape

Privacy changes remain a structural challenge for TTD—less so in CTV, which is already cookie‑less, but more so across mobile and display. The deprecation of third‑party cookies, Apple’s App Tracking Transparency rules, and tighter US and EU regulations have all reduced the signal density that independent platforms rely on. Because TTD’s mobile and display channels still depend on these signals, the shift puts it at a relative disadvantage and limits its ability to deliver higher‑value targeting.

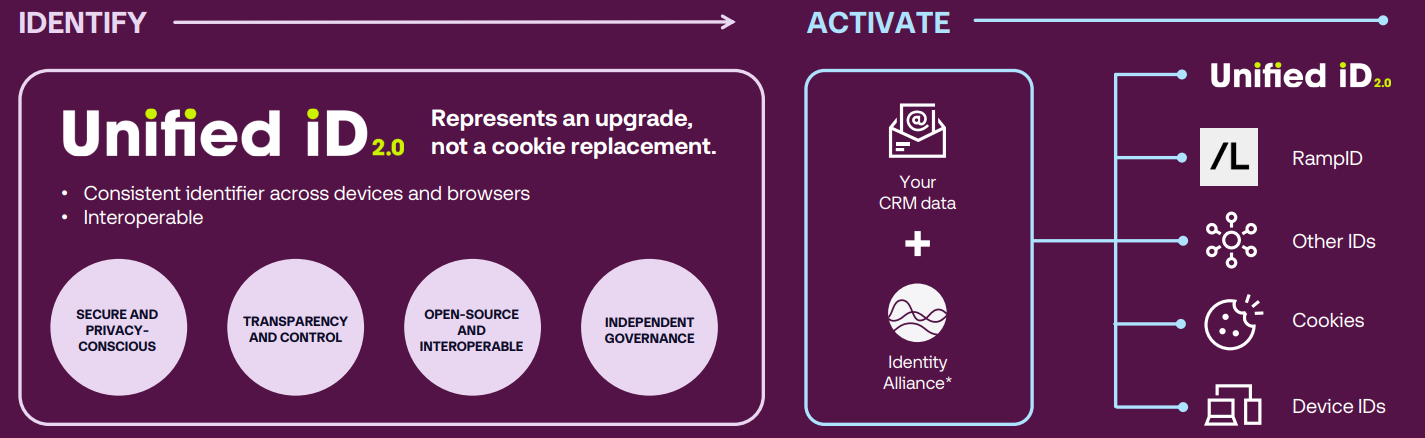

Management is betting that Unified ID 2.0, retail‑media data partnerships, and AI‑driven contextual tools can help offset this signal loss (see discussion of these in the next section below). These are long‑term solutions, and adoption will take time, but they give TTD a credible path to maintaining performance without relying on the kind of vertically integrated identity stacks that regulators are increasingly scrutinising.

Looking ahead, regulators could be both headwind and tailwind—restricting cross‑site tracking while also increasing scrutiny of data concentration inside walled gardens. TTD’s neutrality and privacy‑forward posture position it as a potential part of the solution rather than part of the problem.

How is TTD responding?

Refreshing its senior bench

To address execution challenges and sharpen its go‑to‑market focus, TTD has refreshed several top leadership roles. The recent hires all bring deep experience scaling global ad and software businesses:

Anders Mortensen — Chief Revenue Officer: 25 years of experience scaling large advertising organisations, most recently at Google, where he helped lead one of its fastest‑growing ad units.

Vivek Kundra — Chief Operating Officer: Long track record operating high‑growth software businesses, including at Salesforce, where he helped revenue grow from $2b to more than $8b.

Alex Kayyal — Chief Financial Officer: Two decades as an investor and operator across global tech companies, most recently as a Partner at Lightspeed and previously in senior roles at Salesforce Ventures.

Omar Tawakol — Board Member: Deep background in AI, data, and advertising, with a history of building and scaling platforms in adjacent markets.

Taken together, these appointments signal a clear intent: strengthen execution, improve global reach, and prepare the organisation for its next phase of growth.

Strategic initiatives

To regain momentum, TTD is doubling down on two long‑term initiatives—OpenPath and Unified ID 2.0 (UID2). Both are designed to anchor TTD more deeply within the open‑internet infrastructure.

Each carries execution risk, but together they offer the clearest route to re‑accelerating growth: improving data visibility, expanding margin capture, and strengthening TTD’s role in identity and measurement, especially in CTV where fragmentation and walled‑garden competition are most acute.

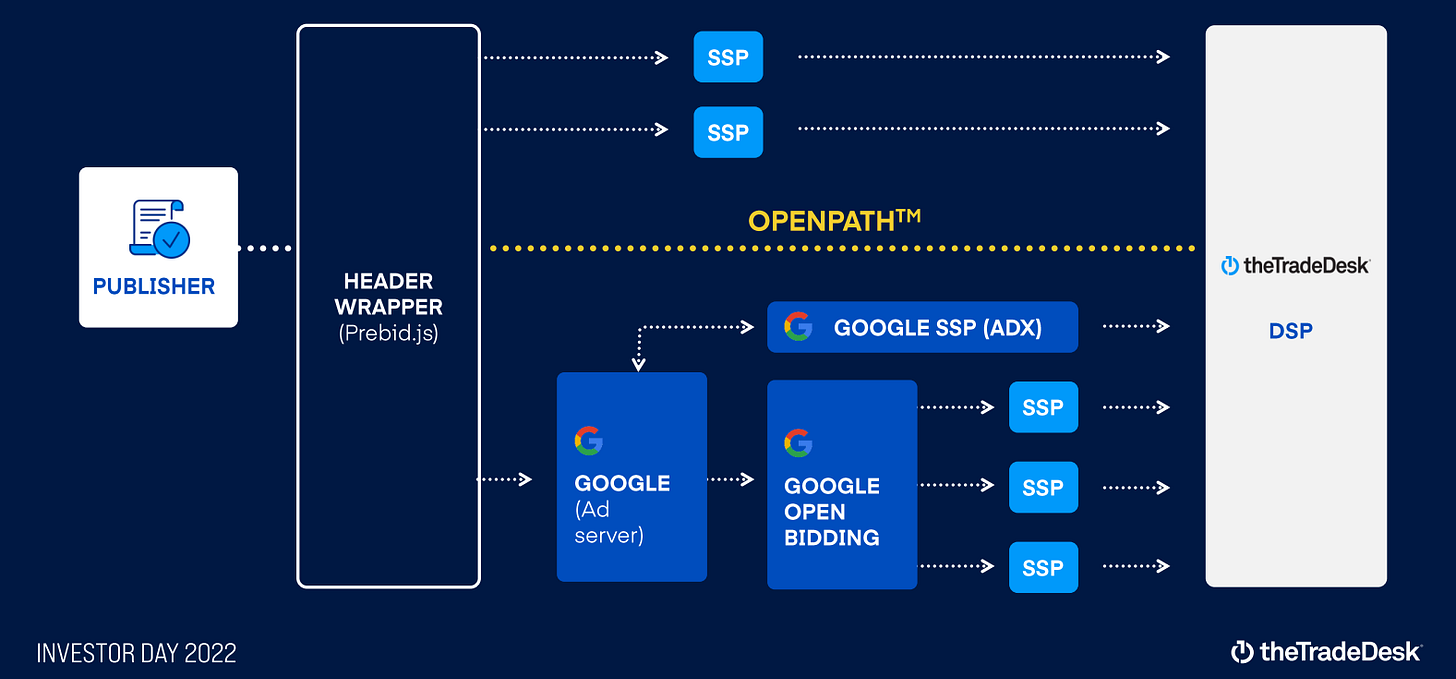

OpenPath – Vertical integration on the demand side

OpenPath connects advertisers directly to publishers, reducing reliance on third‑party SSPs and improving transparency, pricing efficiency, and data feedback loops. As adoption grows, more spend can flow through TTD’s own pipes, lifting take‑rates and deepening performance data. Even a modest mix shift of total spend onto OpenPath-enabled supply can add incremental gross margin leverage, which matters in a model where operating expenses are largely fixed in the near term.

Openpath overview

Source: The Trade Desk investor day presentation October 2022

OpenPath does create tension with SSPs. Historically, SSPs aggregated supply while TTD aggregated demand; now, by offering a direct route, TTD competes for the same economics and data exhaust. Some SSPs may tilt toward rival DSPs, though the broader industry shift toward supply‑path optimisation helps mute this risk.

Early results are promising. OpenPath is live with dozens of publishers and more than 11,000 destinations across CTV, mobile, display, and audio. Freestar’s integration delivered a 3× improvement in inventory fill rates and a 27% lift in programmatic revenue within six months, and major partners like Disney and Warner Bros Discovery have responded positively.

If OpenPath reaches scale, its biggest impact will be less about fee capture and more about strengthening TTD’s underlying advantages: richer log‑level data, tighter optimisation loops, and more bespoke buyer–publisher connections.

UID2 – Identity in a privacy-frst world

UID2 is an open‑source identity framework designed for a privacy‑centric future. It allows advertisers to target and measure audiences without third‑party cookies, using encrypted, login‑based identifiers. If adoption reaches critical mass, UID2 could give the open internet a persistent identity layer that functions more like the first‑party systems of Amazon or Google and, importantly, would reduce the relative performance gap that currently justifies premium budgets flowing toward those closed ecosystems.

Together with OpenPath, UID2 aims to restore some of the closed‑loop precision of walled gardens while maintaining interoperability and neutrality. Adoption will depend on publishers, retailers, and regulators, and policy shifts could either accelerate or slow momentum.

Early signs are encouraging. Warner Bros Discovery has integrated UID2 across its entertainment, sports, news, and lifestyle brands (including Max and Discovery+), and Walmart Connect is actively testing the framework. In Europe, EUID—the regional counterpart—is gaining traction with partners such as DAZN, Bacardi, Kimberly‑Clark, Aller Media, Future, OneFootball, Prisma Media, and Tesco.

One nuance is that UID2’s biggest risk may be its own success. As an open protocol, it is designed for broad adoption rather than exclusivity. If it becomes the dominant standard, TTD’s role as steward could yield deeper integrations and advantaged data flows—but it could also flatten into shared infrastructure that competitors can access on similar terms. The open question is whether UID2 becomes a differentiator for TTD or simply the mechanism that keeps the open web competitive.

Competitive analysis and outlook

One useful way to gauge TTD’s long-term resilience is through Hamilton Helmer’s 7 Powers framework. While TTD doesn’t enjoy the overpowering moats that protect platforms like Google or Amazon, it has assembled a mix of moderate, mutually reinforcing advantages — scale-driven optimisation, increasing switching costs, and a founder-led operating culture that keeps the organisation fast and focused. These strengths don’t produce winner-take-all dominance, but they have kept customer retention above 95% for more than a decade, which is its own quiet mark of resilience.

The landscape around TTD, however, is changing. Amazon keeps widening its edge in CTV by locking down premium inventory and blending it with rich retail and streaming data, creating performance levels that TTD can’t always match. Even so, a meaningful set of publishers remain wary of handing too much data or leverage to Amazon. For them, TTD’s neutrality, interoperability, and steady role in the open internet make it a comfortable and credible counterweight. That positioning may not eliminate the competitive pressure, but it does preserve TTD’s relevance as the market rebalances.

7 Powers analysis

1. Counter Positioning – Weak but durable

TTD’s independence is its most visible point of differentiation: while Google and Amazon design their DSPs to reinforce the value of their own media properties, TTD positions itself as the neutral broker in the middle. That distinction matters, but it doesn’t rise to the level of true counter positioning. For a company to hold that Power, incumbents must experience real economic pain if they try to imitate the entrant’s model. Here, the opposite is true. Google and Amazon remain integrated because it is more profitable for them, not because TTD’s approach would undermine their economics.

That leaves TTD with a form of differentiation that is weak but durable. Its neutrality builds trust, encourages publishers to share data, and positions the company as a stabilising force in the open internet. These benefits reinforce other moats, but they do not compound on their own — making this a steady, rather than transformative, source of advantage.

2. Scale Economies – Moderate and increasing

TTD’s scale advantage doesn’t stem from cheaper infrastructure; it shows up in the quality of outcomes. Each additional impression feeds richer log-level data into the system, refining bidding models and tightening identity resolution. Models trained on a decade of auction history simply make better decisions than those trained on a year’s worth — and that performance gap tends to compound over time.

Scale also unlocks more practical benefits: broader reach, better frequency management, and cleaner cross-channel measurement. As CTV and retail media add more signal into the system, these advantages strengthen. TTD will never approach Google or Amazon in absolute scale, but within the independent DSP universe, it is clearly pulling ahead — and the economics of that position look more like a structurally high-teens grower with stable margins than a commoditised software vendor competing on price.

3. Network Economies – Weak and increasing

TTD does benefit from network effects, but they manifest in quiet, incremental ways rather than the sharp flywheels seen in classic platform businesses. As more advertisers and publishers participate, the system accumulates denser auction data, broader identity graphs, and smoother optimisation. These improvements lift overall performance, though the effects tend to diffuse gradually rather than accelerate dramatically.

UID2 and OpenPath could strengthen these dynamics. If they gain broad adoption, TTD could evolve into more of a connective layer for the open internet — a shared standard that improves efficiency for both buyers and sellers. But adoption is shaped as much by politics as by technology. Large publishers and retailers must trust that these tools serve the ecosystem rather than tilt advantage toward TTD. If that trust holds, the network effects could become meaningfully stronger.

4. Switching Costs – Moderate and increasing

Switching away from TTD is technically possible, but the practical friction is high. Brands and agencies have years of audience definitions, creative assets, measurement frameworks, and model history embedded in the platform. Moving to a new DSP means walking away from that accumulated optimisation — and because bidding models learn from experience, any replacement starts from a weaker foundation.

Identity workflows make the transition even harder. Once a brand’s CRM feeds, conversion events, and household graphs are wired into TTD, rebuilding that architecture elsewhere is slow, lossy, and often comes with a hit to performance. Day-to-day habits add another layer: planning, trafficking, reporting, and creative rotation are deeply ingrained in TTD’s interface.

Agencies amplify this inertia. Retraining large teams, reworking operational processes, and re-establishing data and inventory integrations is expensive and disruptive, which makes full-scale switching rare outside of major failures. Most agencies standardise globally, and TTD is now one of the few independent DSPs embedded across their stacks. Even when a brand wants to test alternatives, staying put is usually the easier path.

All of this creates a durable moat. Switching can happen, but it is painful enough that TTD has held retention above 95% for more than a decade. As campaigns become more complex and identity frameworks more deeply integrated, these switching costs only continue to rise.

5. Branding – Weak and stable

TTD’s brand is built on trust more than on emotion or identity. Its independence, transparency, and long-standing support for the open internet aren’t traditional brand attributes, but they carry weight in a landscape dominated by vertically integrated platforms. Agencies tend to view TTD as the reliable, neutral option; publishers see it as a collaborator rather than a competitor; and regulators often treat it as a useful counterbalance to the largest walled gardens.

That said, this doesn’t translate into premium pricing or deep, irrational loyalty. Advertisers don’t choose TTD because of its name — they choose it because the platform delivers dependable performance without the conflicts of interest embedded in closed ecosystems. The brand amplifies other strengths, but it isn’t a moat on its own.

As a result, branding remains a weak but steady Power: consistent, reputation-based, and supportive of the broader narrative TTD has built, but not a structural advantage in isolation.

6. Cornered Resource – Weak but emerging

TTD doesn’t control the proprietary consumer data or premium inventory that anchor the deepest moats at Google and Amazon. Instead, its efforts around UID2 and OpenPath are attempts to build shared infrastructure that nudges the open internet toward common, interoperable standards. These tools are strategically important, but they are not cornered resources today.

UID2 is intentionally open, built to be adopted broadly rather than owned outright. OpenPath is more differentiated, but it still functions as an integration layer rather than a piece of exclusive supply. If both initiatives scale, TTD could settle into a soft infrastructural role — a trusted steward that partners rely on for identity, authentication, and efficient supply routing. That position would come with influence, deeper integrations, and a quieter form of defensibility.

For now, though, this Power remains early and uncertain. The potential is meaningful, but it only hardens if adoption reaches critical mass across major publishers, retailers, and agencies.

7. Process Power – Moderate and increasing

TTD’s operating rhythm increasingly reflects genuine Process Power — a collection of routines and decision patterns that competitors have found difficult to imitate. The company’s ability to iterate quickly, collaborate openly with partners, and run experiments in full view of the ecosystem shows up across its work, from onboarding publishers to testing identity frameworks to integrating new CTV supply.

Competitors have tried to match this pace and struggled. DV360 often contends with internal trade-offs that slow decision-making, and Amazon tends to move methodically outside its core retail and commerce engine. These gaps suggest that TTD’s speed and clarity aren’t just cultural preferences; they are embedded into the way the organisation is wired.

Founder leadership strengthens this advantage. Jeff Green’s transparent, ecosystem-first style shapes how teams prioritise, communicate, and ship product. Replicating that style would require rivals to rethink how decisions flow through their organisations — a costly and slow undertaking. Over time, these routines compound into a form of defensibility that is subtle but meaningful.

Process Power isn’t yet a dominant moat, but it is clearly strengthening and gives TTD a distinctive ability to adapt as the market evolves.

Power summary

Viewed together, TTD’s Powers form a set of moderate but reinforcing advantages. Its independence and reputation create the trust that underpins deep agency and publisher partnerships. Those relationships, in turn, strengthen scale economies and amplify switching costs. Layered on top is an operating culture that continuously absorbs ecosystem feedback and converts it into product improvements at a pace the larger platforms often struggle to match.

This collection of strengths doesn’t guarantee market leadership — Amazon and Google still sit atop the most valuable data and premium inventory — but it does point to a foundation of durable relevance. If UID2 and OpenPath continue to gain traction and mature into broadly adopted standards, these Powers could compound further, anchoring TTD more deeply in the infrastructure of the open internet.

Investment view

TTD’s original vision — a transparent, neutral, market-like platform for digital advertising — still holds, but the competitive backdrop has become more demanding. Growth has moderated, premium CTV supply is increasingly consolidated, privacy reforms continue to erode open-internet signal, and walled-garden pressure has intensified. Against that backdrop, the central question for investors is whether neutrality can still deliver performance that keeps pace with platforms built on proprietary data and closed ecosystems.

We view the outlook through three structural forces shaping the next phase of the open internet:

Digital and CTV migration: Streaming continues to pull dollars from linear TV, but the extent to which independent DSPs retain access to premium CTV inventory will set the ceiling on TTD’s growth. The migration is real, but the distribution of supply remains the key variable because it determines whether TTD’s long-term growth converges toward overall digital ad growth or can sustain a structural premium through continued share gains.

Identity rebuild in a privacy-centric world: With cookies and mobile IDs fading, UID2 and EUID sit at the center of whether the open internet can maintain addressable advertising at scale. Their adoption trajectory will shape both performance and long-term competitiveness.

AI-driven automation: As machine learning reduces operational complexity, DSPs must prove they can deliver strong results without relying on privileged first-party data. The degree to which Koa/Solimar becomes the default workflow for agencies will be an important marker of TTD’s momentum.

Across these forces, owning TTD remains a bet on the durability of the open internet and the economic value of neutrality in a privacy-first world. The following section outlines the valuation framework and IRR sensitivities under each scenario.

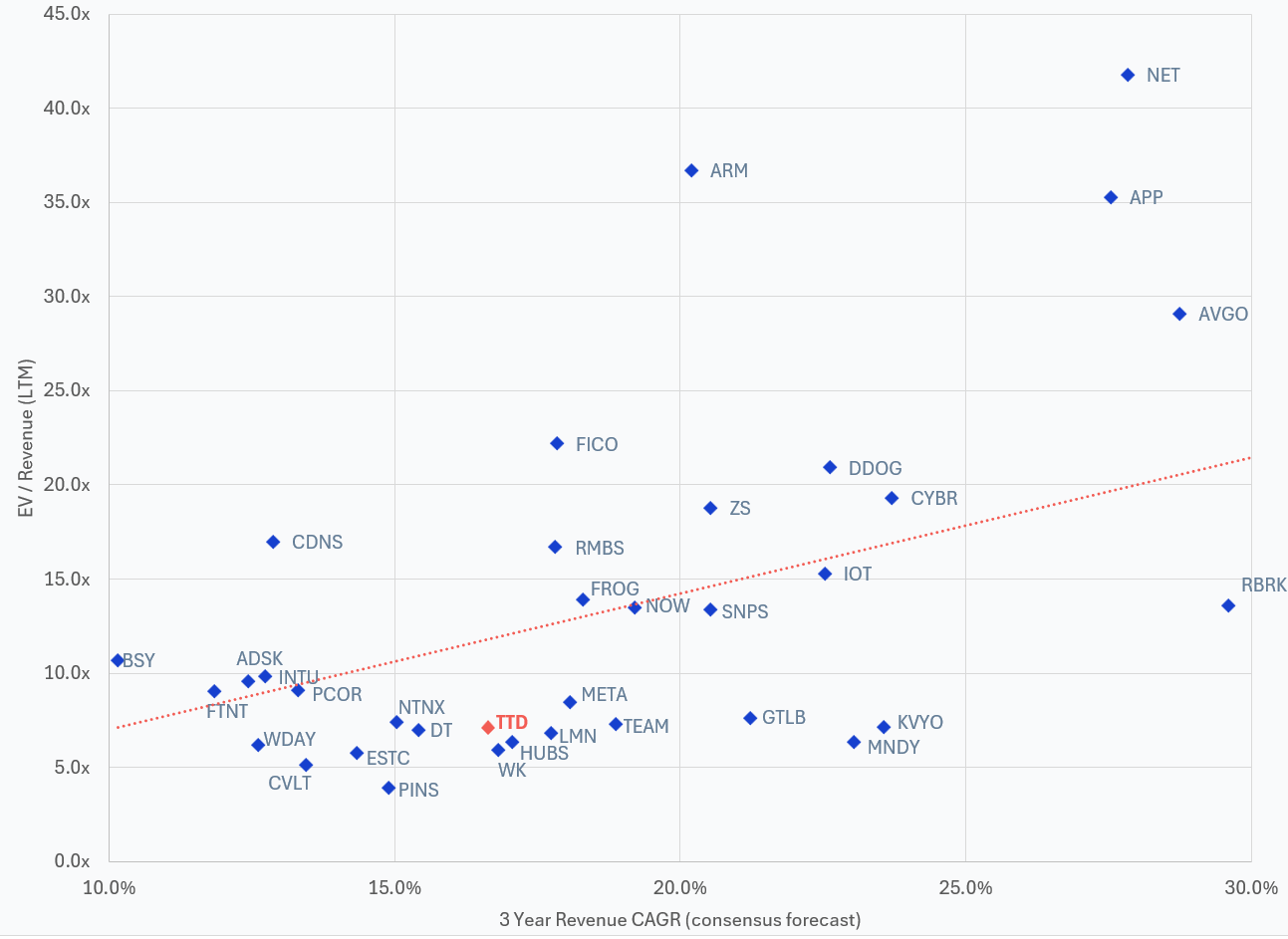

Valuation benchmarking

To frame TTD’s valuation, we compared it against a set of 37 software peers expected to grow revenue between 10% and 30% a year over the next three years, all with gross margins above 75%. Within this group, TTD sits toward the lower end of the valuation range at 7.3x LTM revenue. Only a few companies with comparable or faster growth — including HubSpot at 6.3x, Monday.com at 6.3x, and Workiva at 5.9x — trade meaningfully lower.

From here, the near-term downside looks limited to another turn of multiple compression, which would take the stock down c.14% to roughly $37/sh. By contrast, a re-rating back to the peer trend line of around 12x would imply a move to c.$71/sh, or roughly 65% upside.

Put differently, the market is already pricing TTD as a “low-end of high-growth” asset; any evidence that it can defend mid-teens growth with stable margins forces a re-rating toward the centre of the peer set.

EV / revenue multiple and 3 year revenue CAGR

Source: Koyfin (10 Nov 2025)

Base Case — 20% IRR

In the base case, digital and CTV migration continue at a steady pace, but access to premium CTV inventory remains partly constrained by the major streaming platforms. Independent DSPs retain meaningful reach, but not full parity with the walled gardens. UID2/EUID see moderate, industry-standard adoption — enough to rebuild usable signal density across the open internet, though not enough to become the dominant identity layer. AI automation expands access for mid-market buyers but doesn’t materially compress take rates or close the performance gap with Amazon’s closed-loop data.

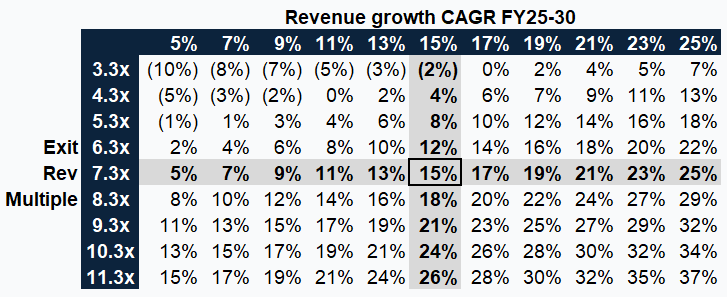

Against this backdrop, TTD sustains a c.15% revenue CAGR, driven by stable agency relationships, incremental share gains in open-internet video, and continued international expansion. If the company can prove that mid-teens growth is both durable and predictable, a re-rating toward c.10x revenue — still comfortably below historical highs — appears reasonable and assuming stable margins supports a c.20% equity IRR from today’s levels.

IRR sensitivity analysis

Note that our estimates assume no net dilution, with buybacks offsetting SBC (in-line with historical trends)

Bull Case — 40% IRR

In the bull case, the open internet retains real competitive relevance even as consolidation continues. Major publishers keep meaningful portions of their CTV inventory accessible through programmatic channels, and after a period of testing semi-walled approaches, the market leans back toward transparency and interoperability. UID2 and EUID see broad uptake across agencies, retailers, and premium publishers, restoring cross-site addressability to a level that meaningfully narrows the ROAS gap with the walled gardens.

AI becomes an accelerant rather than a commoditiser. Koa and Solimar evolve into the default workflow layer for many agency teams, embedding identity, planning, and creative optimisation in a single environment. As these capabilities integrate more tightly, switching costs deepen.

Under these conditions, TTD reaccelerates to 20%+ revenue growth, and investor confidence supports a return to c.15x revenue.

Bear Case — c.0% IRR

In the bear case, the open internet shrinks in scope and relevance. Major streaming platforms — including Disney, Amazon, and Netflix — reserve most premium CTV inventory for their direct-sold or vertically integrated channels, leaving independent DSPs with thinner supply and weaker signal density. At the same time, privacy reforms tighten, slowing UID2 adoption and constraining cross-site visibility. As signal quality erodes, the performance gap between programmatic and contextual advertising narrows.

AI also shifts from enabler to commoditiser. Optimisation becomes table stakes, and the platforms with proprietary data and closed-loop attribution — notably Amazon and the walled gardens — capture a larger share of spend. Agencies respond by funneling more budgets through those closed systems or through hybrid in-house stacks, reducing TTD’s footprint to upper-funnel or brand-oriented campaigns.

In this scenario, revenue growth decelerates toward a c.10% CAGR, and the multiple compresses toward c.5x revenue.

Final Takeaways

TTD’s growth has slowed and competition has intensified, but the company’s core strategic pillars remain solid—and in some areas, stronger than before. Its reputation for trust, neutrality, and transparency continues to matter in a market where those characteristics are increasingly rare.

Performance in the short-term is likely to remain choppy as the industry works through privacy changes, shifts in CTV supply, and volatile investor sentiment. The medium-term picture, however, is more constructive than recent volatility suggests. Holding c.15% revenue growth with even modest multiple expansion already supports a >20% IRR, and progress on identity and direct integrations provides meaningful upside—especially if OpenPath and UID2 move from valuable tools to the default rails for a larger share of open-internet spend.

Taken together, TTD offers a blend of durability and built-in optionality. Neutrality may limit how dominant the company can be in the short run, but it also underpins the trust and cross-platform access that strengthen its role as the ecosystem reshapes itself.

Jeff Green’s founding philosophy still resonates: build for the long term, operate transparently, and focus on the rails others rely on. In a landscape marked by rising opacity and consolidation, that orientation is becoming more—not less—strategic.

Regarding the topic of the article, I'm curious about the long-term impact of AI on TTD's data-driven model, especially with the walled gardens tightening. How do you see that playing out? Your analysis on their open internet position is truely insightful.

Why does 15% revenue growth imply a valuation of 10x revenues?