Cloudflare Q3 FY25 | Growing its Enterprise muscle; Accelerating Into the AI Cycle

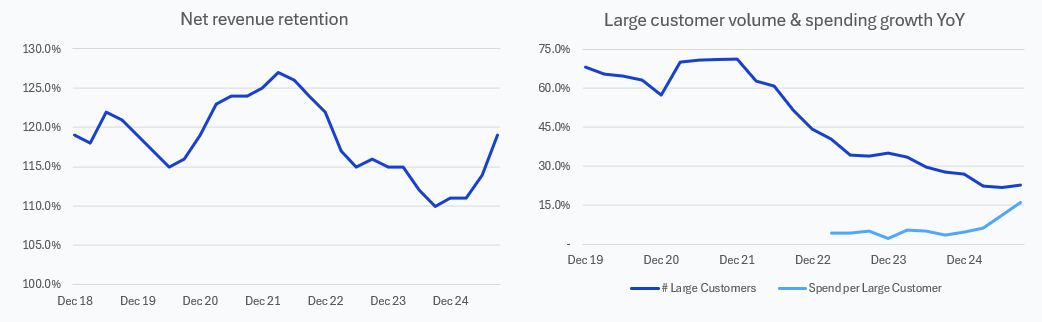

Cloudflare (NET 0.00%↑) reported a stellar Q3 FY25 result, posting NRR of 119% — the highest it’s been in nearly 3 years — and reinforcing confidence in the company’s transition to becoming a viable competitor in the Enterprise sales world. The share price responded in kind, with Cloudflare jumping 14% on the day to $253.30.

In this article we discuss the result, what it means for our investment case, and what you need to believe to buy Cloudflare at these levels.

Q3 FY25 result

The most important factor underpinning Cloudflare’s long-term success is its ability to win and grow Enterprise contracts — a muscle it has slowly been building; transitioning from product-led growth to an enterprise sales model.

Sales productivity has increased for seven consecutive quarters, and anecdotally the company has been closing the feature gap across multiple Acts. It’s pleasing to see this translate into continued momentum in both average customer spend and logo wins — driving revenue from large customers (>$100k ARR) up 13% QoQ and 42% YoY.

NRR and large customer revenues

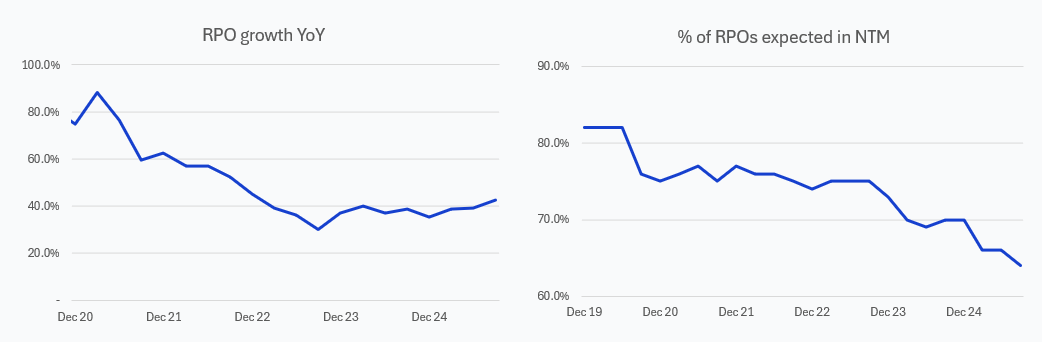

RPO growth of 43% YoY, the highest since Dec 22, points to continued momentum into FY26, with contract mix shifting further toward multi-year commitments (now c.35% of total value). Management also noted that “Pool of Funds” contracts, where a large customer commits a pre-specified amount of spend (pre-paid, multi-year or multi-product) that they can draw against across multiple Cloudflare product lines, now represent low double digits of total ACV — a positive signal of ecosystem buy-in.

RPO growth and composition

Reinforcing this, the company highlighted several notable recent deals in the quarter. Recent wins span all three Acts — from core infrastructure to AI-driven workloads:

$34.3m 5-year contract with a European tech company redesigning architecture on Workers and Durable Objects.

$22.8m 3-year contract with a Global 2000 digital media platform emphasizing AI-driven web protection and Pay Per Crawl.

$15m 3-year contract with a media platform to reduce egress fees and latency, lowering total cost of ownership by 30%.

$16.1m 2-year contract with a Fortune 500 fintech company expanding across multiple Cloudflare products.

$20m+ 2-year contract with a U.S. cabinet-level agency standardising on Cloudflare’s FedRAMP portfolio, displacing legacy solutions and saving $10m annually.

What does this mean for our investment case?

This result doesn’t change our thesis — it strengthens it. Cloudflare continues to prove it can win in the enterprise while maintaining its pace of product delivery.

In our previous article, we did a deep dive of Cloudflare, analysing the company in the context of Hamilton Helmer’s 7 Powers and examining its strategic positioning relative to other incumbents across each of its product lines.

We rated Scale Economies as the company’s greatest strength, leveraging its global anycast network to power multiple product types across its 3 Acts and amortising its cost base over a far bigger TAM than any direct competitor (ex Hyperscalers).

We identified the company’s biggest risk as being stuck between low-cost ‘good enough’ solutions (e.g. a Microsoft bundle) and best-in-class point solutions (e.g. Zscaler in Zero Trust). Recent results have continued to add weight to the argument that Cloudflare is a viable competitor at the top end, rapidly shipping new features and coming closer and closer to feature parity.

While this supports our investment thesis, the challenge we continue to have is Cloudflare’s extremely rich price (see further discussion below). At $253.3, there is little room for error and no margin of safety.

Our base case model prices Cloudflare at $208.9, and we plan to opportunistically add to our position when Mr Market has an off day. Cloudflare is a name to own for the long term, but for right now it’s a Hold.

Valuation and forecast update

Cloudflare’s value lies in its long-duration growth curve — a fat tail that demands sustained reinvestment and depresses near-term cash flow. This means the factors that are most important from a valuation perspective are A) revenue growth and B) the terminal revenue multiple that is applied.

These are inherently linked; a slowdown in growth will compress the multiple — a double whammy to valuation. While the opposite is also true, it’s much harder to increase by 2x from here than to decrease. Increasing would imply a c.70x NTM revenue, moving to a realm shared by few others (such as Palantir), while decreasing 2x brings you in line with some still expensive, high quality names like Snowflake and Zscaler.

Growth forecasts

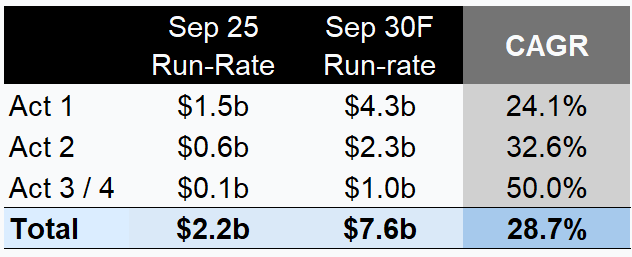

We derive an above consensus growth forecast of 28.7% (consensus c.25%) over the next 5 years, predicated on Cloudflare roughly doubling its market share of Acts 1 and 2, and successfully executing the growth strategy across Acts 3 and 4.

Act 1: Implies revenue similar to Akamai today, going from c.3.6% to 7.2% market share.

Act 2: Implies revenue similar to Zscaler today, going from c.1.3% to 2.4% market share.

Acts 3 / 4: Management estimate Act 3 alone as having >$50b TAM. We believe a 50% CAGR is a fair base case, in-line with how Cloudflare grew earlier products over 2018-22. We could easily see this expanding well beyond this level, particularly given gravity from the rest of the ecosystem and massive tailwinds from AI uptake.

Indicative bottom up revenue forecasts by product Act

Multiple analysis

As discussed in our previous Cloudflare deep dive, Cloudflare has a structural cost advantage relative to peers and we also believe strong Process Power enables rapid product iteration and expansion at a superior pace. Both factors support above-market revenue growth and a higher than average multiple.

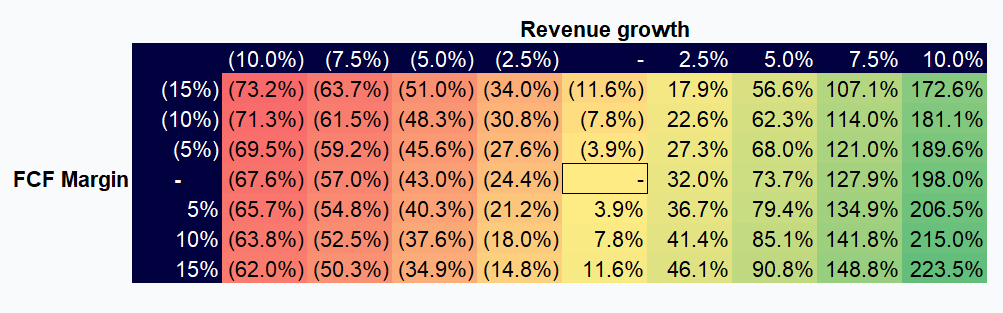

The below table highlights the relationship between growth and margins on the valuation multiple based on a DCF, assuming these differences hold for 15 years.

Valuation multiple sensitivities

Margins: Today, Cloudflare has low FCF margins — a function of significant platform investment, tactically sharp price points, and heightened sales spend as it drives growth. Our long-term forecasts estimate Cloudflare’s margin grows to c.25% by 2035; however this remains behind the majority of leading cybersecurity firms.

Growth: Revenue has a much bigger multiplier impact than margin because of its compounding effect. Recurring revenue growth impacts value into perpetuity, while margins are transient to any given year. Cloudflare will likely continue to grow above market, but the key questions are how far above and for how long.

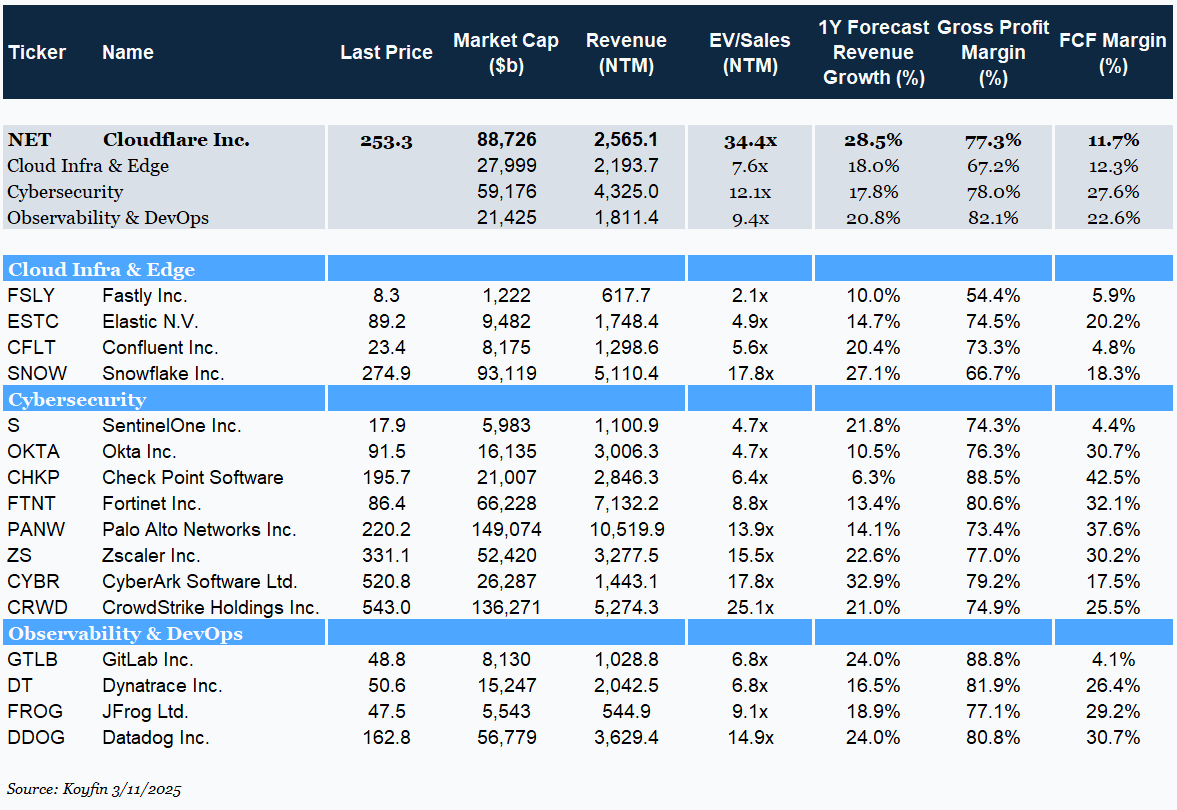

Cloudflare’s revenue multiple of c.34x is significantly higher than all the peers we have listed, including direct competitors Palo Alto (+150%) and Zscaler (+120%). Using the above matrix, this implies the market is pricing in a persistent growth differential of >7.5%. This is certainly possible, but to outperform for the next 15 years is a tall order that leaves little room for error and no margin of safety.

At these levels, even small execution missteps could trigger multiple compression. It’s a business we want to own more of — just not at any price.

We hold Cloudflare as an optionality position, and plan to continue adding when the opportunity presents itself, but for now see better value in other names like Zscaler — click here to read our ZS investment thesis.